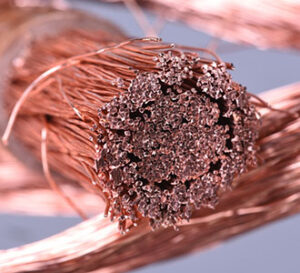

COPPER

While the futures contract has corrected from last Friday’s spike up move, US traded copper is lagging Shanghai copper this morning which posted a 2-month high overnight off a tight supply theme. In addition to another daily decline in LME copper warehouse stocks, the Shanghai Futures Exchanges indicated every stockpile of commodities and refined metals at their warehouses declined over the last week (copper, aluminum, zinc, nickel, lead, and Tin). In another positive development, premiums for copper in China strengthened and there is apparently a significant surge in calls for additional Chinese targeted stimulus from state media and key advisors to the government which could result in fresh supportive news this week. In fact, Chinese copper premiums have reached the highest level since October in a sign that interest in prompt supply is picking up speed.

GOLD / SILVER

While the dollar is not giving off a definitive impact on gold and silver prices early today, the currency index generally maintains an upward tilt on its charts and could be a minor limiting force today. Obviously, the major event of the day and this week is the US Fed chairman testimony to Congress with the general expectation the chairman will return to the rate hike mantra following the June pause. Of particular importance to the precious metal trade is the clarity and perhaps reiteration of previous comments projecting only two small interest rate hikes before the end of the year. While gold ETF holdings busted a several week straight pattern of outflows with an inflow of 27,273 ounces yesterday, holdings year-to-date have declined signaling an ongoing lack of investment interest. Silver ETF holdings declined by 229,809 ounces yesterday and are nearly 1% lower year-to-date. Even the Chinese investor has turned cool toward gold with economists suggesting Chinese gold buying growth is slowing after the post Covid buying surge with that signaling the economy in China is losing momentum. Nonetheless, Chinese retail sales of gold and silver jewelry rose 24% year-over-year in May which pales in comparison to the previous 2 monthly readings of +37% and +44%. On the other hand, Chinese gold market analyst indicate purchases from the Peoples Bank of China could offset the decline in Chinese retail gold sales. Today’s US economic report schedule is very thin and unlikely to impact gold and silver prices but in addition to the Fed chairman testimony to Congress this morning the trade will see three other Fed speeches in the trade today.

PLATINUM / PALLADIUM

With a fresh lower low for the move, the July platinum contract looks to knife through $950 psychological support and continue toward the early March consolidation low down at $938. Unfortunately for the bull camp, Chinese electric vehicle registrations jumped 15.2% in May which clearly takes market share from internal combustion engines using auto catalyst. Similarly, European EV car sales in May saw a jump of 40% in the first 5 months of 2023. In yet another definitively bearish development, platinum ETF holdings declined by a very large 33,538 ounces and have now reduced their year-to-date gain to 5.3%. In addition to disappointment over the lack of optimism toward the Chinese economy after further support from the government, lower Swiss platinum exports and given platinum ETF holdings last week declined by 80,978 ounces, the platinum trade has been hit with softer demand signals from both physical and investment interest. With an extension of “risk off” sentiment today from soft global equities and fear of the US Fed, the July platinum contract looks on track to hit an ultimate downside target of $938. With the charts in palladium damaged again yesterday and again this morning the psychological support level of $1350 is unlikely to prop up prices today.

Interested in more futures markets? Explore our Market Dashboards here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.