Soybeans, soyoil and wheat traded higher. Soymeal and corn were unchanged. US stocks were higher. US Dollar was lower. Gold was sharply higher.

SOYBEANS

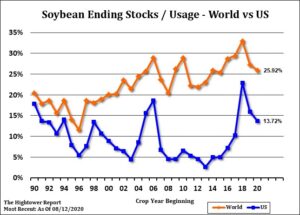

Soybean traded higher. Concern about hot and dry US Midwest Weather lowering US 2020 crop size and continued China buying US soybean triggered new buying. This offset talk of higher Brazil supplies. SX made new highs since Jan 30. Concern about dry August US weather and China buying has erased all of the trade war losses. The debate now is there enough concern to push prices higher with US harvest approaching. SX is becoming oversold. Managed funds are adding to their net 115,000 contract long. Trade estimates weekly US soybean export sales near 700-1,300 mt versus 1,573 last week. USDA announced 400 mt US soybeans sold to China for 2020/21 crop year. Some estimate that China has now bought 19.8 mmt of US new crop soybeans. Weather forecast still suggest a cold front will bring .50-2.50 inches of rain across the central and east Midwest early next week. Noon maps were drier for Iowa next week. FH Sep weather maps suggest normal rains and normal to below temps for much of the Midwest.

CORN

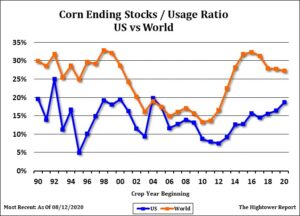

Corn futures traded unchanged. On Tuesday, open interest was down sharply as managed funds continue to liquidate net short positions. Funds are now net short 65,000 contracts. Corn futures are overbought. Some still say that current global fundamentals do not justify CZ over 3.60. At the same time same group suggest harvest lows may be closer to 3.00-3.20. Weekly US corn export sales are estimated near 1,200-2,200 mt versus 723 last week. China, Mexico and Japan showed up as new buyers. It was interesting that China Chairman asked consumers to halt the waste of food. Some thought that could indicate a food shortage. China Ag Minster quickly clarified the Chairman’s remarks as during this virus crisis and that China will harvest a bumper crop in 2020. This could ease record high domestic corn prices. Some are lowering US 2020 corn crop to 179 bpa. The lower yield could be partially offset by a drop in total demand. A few in the driest states would suggest an even lower corn yield. US weekly ethanol production was down 10 pct versus last year. Stocks are down 11 pct versus last year. Margins did improve. Weather forecast still suggest a cold front will bring .50-2.50 inches of rain across the central and east Midwest early next week. Noon maps were drier for Iowa next week. FH Sep weather maps suggest normal rains and normal to below temps for much of the Midwest.

WHEAT

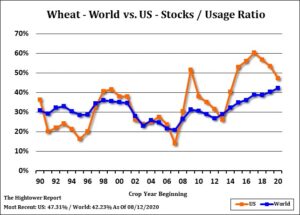

Wheat futures traded higher. Fact US and China had a positive trade talk raised hope that they would become net buyers of US wheat. French Matif Wheat futures continued to trade higher on new talk of lower supplies and China buying. WZ traded back up to near the higher end of this years trading range and 5.40. Open interest has dropped as managed funds liquidated net shorts. KWZ tested 4.60 support. MWZ tested the 100 day moving average near 5.34. Commodity markets will be watching US Fed Chairman comments on new inflation policy and talk they will keep US interest rates at zero for 5 years. Covid is still reducing Global food and fuel demand. US restaurants are still not using as much food as before Covid. Weekly US wheat export sales are estimated near 400-700 mt versus 523 last week. Global wheat trade remains slower than expected. Rally in US futures now has US HRW export prices $5-10 dollar over German and Baltic prices and $20 dollars over Russia. USDA estimate of World wheat stocks at a record 317 mmt still limits the upside in prices.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.