Soybeans, soymeal, soyoil and wheat traded higher, nearby corn traded lower. US stocks were higher. Crude was higher. Gold was higher. Hogs were sharply lower today.

SOYBEANS

Soybeans traded higher. NOAA 90 day US Midwest forecast of above normal temps and normal rains east but below normal rains west may have supported soybean futures. US March NOPA soybean crush was higher than last month but below trade guess. Soyoil stocks were below last year and last month. World vegoil prices continue to trade higher on lower sunoil and rapeseed oil supplies and talk of higher demand for palmoil. Both Matif rapeoil and Canada rapeseed futures traded higher. Brazil farmers may be defaulting on cash soybean sales and Argentina rains may be lower Argentina crop and quality. Weekly US soybean export sales were only 3 mil bu. US soybean export commit is near 2,232 mil bu vs 1,377 last year. USDA goal is 2,280 vs 1,682 ly. SK 2021 range has been 13.50-14.50. Some feel SK could soon trade over resistance.

CORN

Corn futures were mixed with nearby May trading lower and new crop Dec seeing small gains. NOAA US 30 day outlook suggesting above normal temps and normal east Midwest rains suggest that US corn crop will get planted on time. Current colder than normal temps may be slowing planting and germination. Weekly US corn export sales were near 13 mil bu. US corn export commit is near 2,630 mil bu vs 1,361 last year. USDA goal is 2,675 vs 2,778 ly. USDA est of World corn exports are near 187.2 mmt vs 171.7 last year. US corn export commit to China is 23.2 mmt with 9.5 shipped. There is 3.4 in unknown. USDA est China total imports at 24 mmt. Some feel China import guess includes 6 mmt US corn rolled from old crop to new. Commercials feel China will ship that 6 mmt. Weekly US sorghum sales were a record 656 mt. Total commit is near 7.0 mmt vs 3.1 ly. Brazil is dry. Brazil is importing Argentina corn. CK made new highs above 6.00. There was some long liquidation into the weekend. Some feel CK could soon test 6.25.

WHEAT

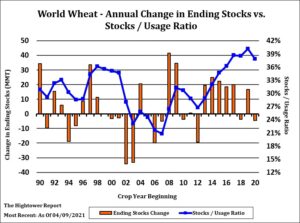

Wheat futures traded higher. Managed funds added to net long positions on concern over west EU, Canada and US north plains long range weather forecast. High World corn prices also helped wheat. Wheat discount could increase already high wheat feeding and lower carryouts. Some feel World wheat exports need to add 12-15 mmt of wheat production to avoid 5th straight year on World wheat stocks decline. Weekly US wheat export sales were -2 mil bu. US wheat export commit is near 923 mil bu vs 926 last year. USDA goal is 985 including flour vs 965 ly. USDA est of World wheat exports are near 198.9 mmt vs 190.4 last year. WK has rallied from 5.93 to 6.57. Resistance is near 6.60 then 6.80. KWK has rallied from 5.53 to 6.10. Resistance is near 6.20 then 6.40. MWK has rallied from 5.96 to 6.68. Resistance is near 6.70 then 7.00.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.