GOLD / SILVER

While not significant news, gold ETF’s saw an inflow yesterday of 2,523 ounces yesterday and that supportive news is joined by evidence that Chinese gold imports are recovering, with Hong Kong March net gold exports to mainland China coming in at 4 times the level seen in February (16.5 tons versus 4.1 tons). While gold and silver might draft some support from expectations of stronger Chinese PMI readings for April ahead the US gold market is held back by a lower Shanghai-gold-futures close, and by a stronger dollar.

PLATINUM / PALLADIUM

With another new record high in the early going today and the palladium market spending almost the entire overnight trade in positive territory, the path of least resistance remains up. While palladium ETF holdings only added 463 ounces yesterday, they remain 2.4% higher on the year and platinum ETF holdings added 5,632 ounces and are 1.2% higher on the year.

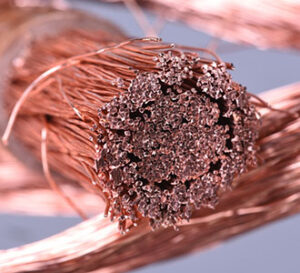

COPPER

Not surprisingly, the copper contract has forged a fresh contract high this morning with large portion of those gains coming from fresh fears of supply problems in Chile, signs of forward momentum in the Chinese economy (Chinese air travel back at pre-pandemic levels and expectations of positive Chinese PMI readings later this week.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.