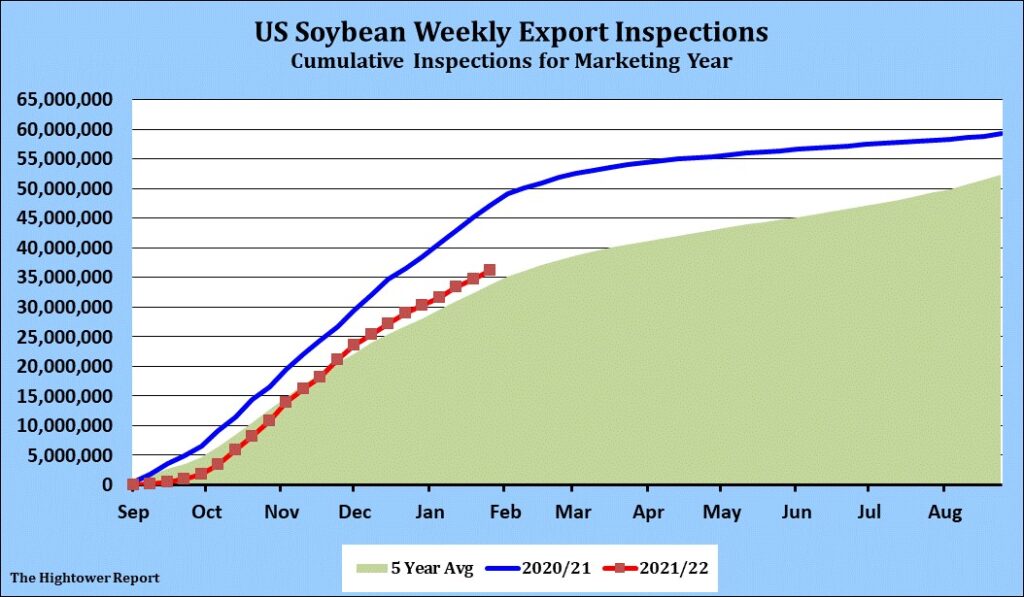

SOYBEANS

Soybeans ended higher. China is on holiday but USDA still announced new US soybean sales to China both old crop and new. Some feel the rally in soybeans was linked to talk that Final Brazil soybean crop could be near 125 mmt and well below the first estimate of 144. There was also talk that Argentina crop could be closer to 40 mmt vs USDA 46.5. Weekly US soybean exports were near 52 mil bu vs 70 last year. Season to date exports and near 1,332 mil bu vs 1,744 last year (-412). USDA goal is 2,050 vs 2,265 last year (-215). SX is making new highs on talk US 2022/23 US balance sheet may be tighter than 2021/22. SN-SX spread is testing May,2021 high near +126.

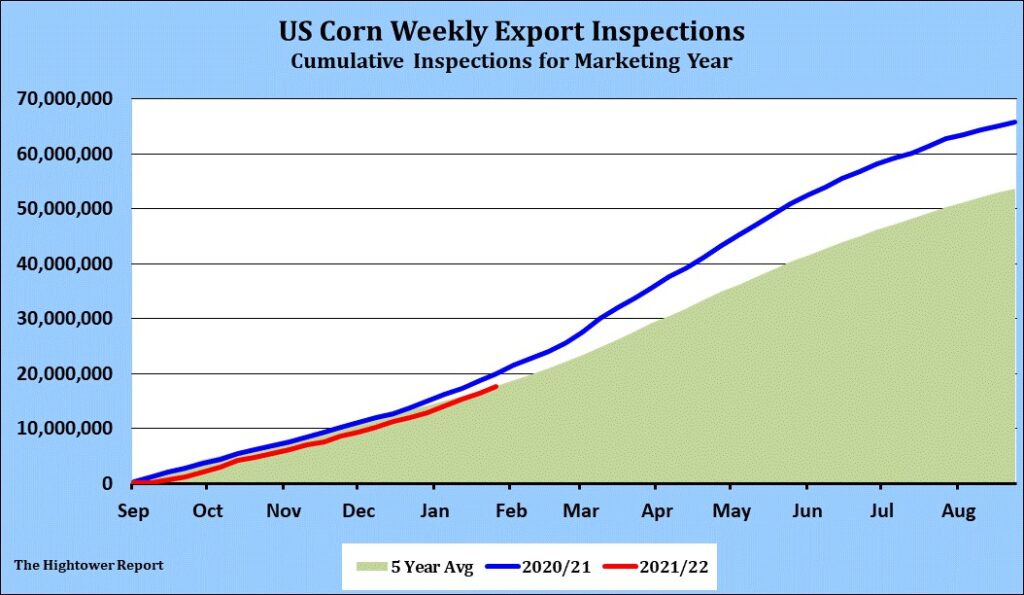

CORN

Corn futures traded sharply lower. Month end long liquidation and weaker wheat prices may have triggered selling. CH did manage to trade over 6.40 contract highs below falling back from an overbought technical picture. Most of the news remains the same. There is talk that Brazil 2022 corn crop may be a slow as 106 mmt versus USDA first estimate of 118. There is also talk that Argentina corn crop could be 50 mmt versus USDA 54.0. This would suggest a drop of 16 mmt or 600 mil bu. There has been some reduced concern about Russia invading Ukraine after Russia comments that there was not proof of Russia intending to invade Ukraine. Weekly US corn exports were near 41 mil bu vs 44 last year. Season to date exports and near 691 mil bu vs 788 last year (-97). USDA goal is 2,425 vs 2,753 last year (-328). Final US exports could be closer to 2,680. Some are now using a US 2021/22 carryout of 1,200 due to higher ethanol and export demand. CN-CZ corn spread found resistance near +56. Key resistance is near +58. Spread should trade over +58 if US demand increases.

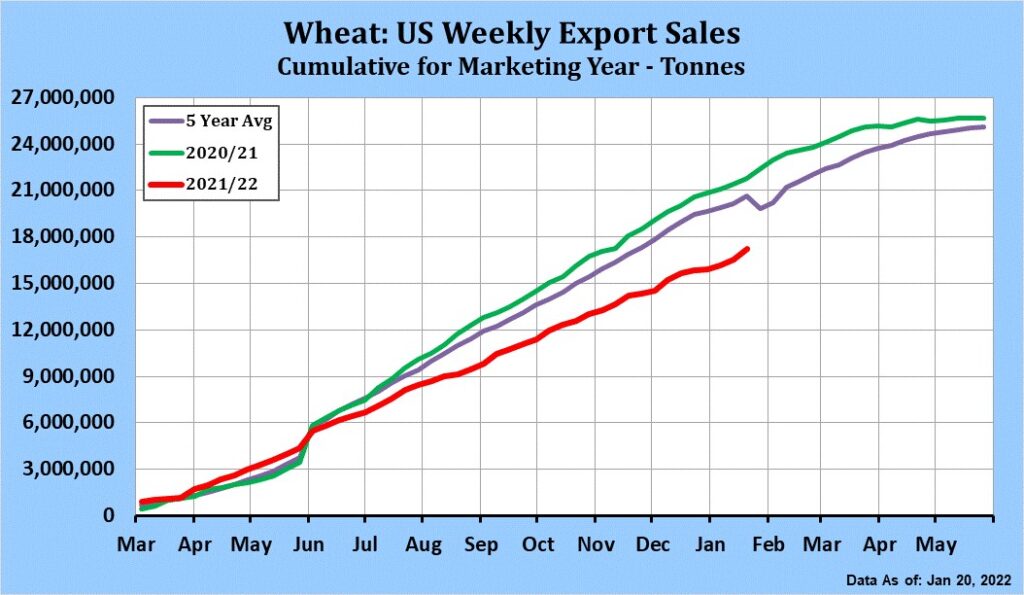

WHEAT

Wheat futures traded lower. Wheat futures traded lower on less talk about Russia invading Ukraine. Russia UN Ambassador said that there is no proof of Russia invading Ukraine despite Russia troop buildup on the Ukraine border. There is continued talk that Russia final wheat exports could be closer to 32 mmt versus USDA 35. Fact that Egypt tender was at prices lower than expected with French wheat even lower than Russia or East Europe. Slow US wheat export shipments and fact US HRW export prices are still a discount to EU and Russia offers resistance. Weekly US export inspections were near 13 mil bu vs 15 last year. Season to date exports are near 499 vs 608 last year. Parts of US south plains could see some moisture in the form of snow and freezing rain. Up until today, in January Chicago wheat futures were up 23 cents, KC wheat up 11 cents and Minneapolis wheat was down 52 cents. Nearby corn futures were up 47 cents. Oat futures were up 115 cents

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.