London Wheat Report

Source: FutureSource

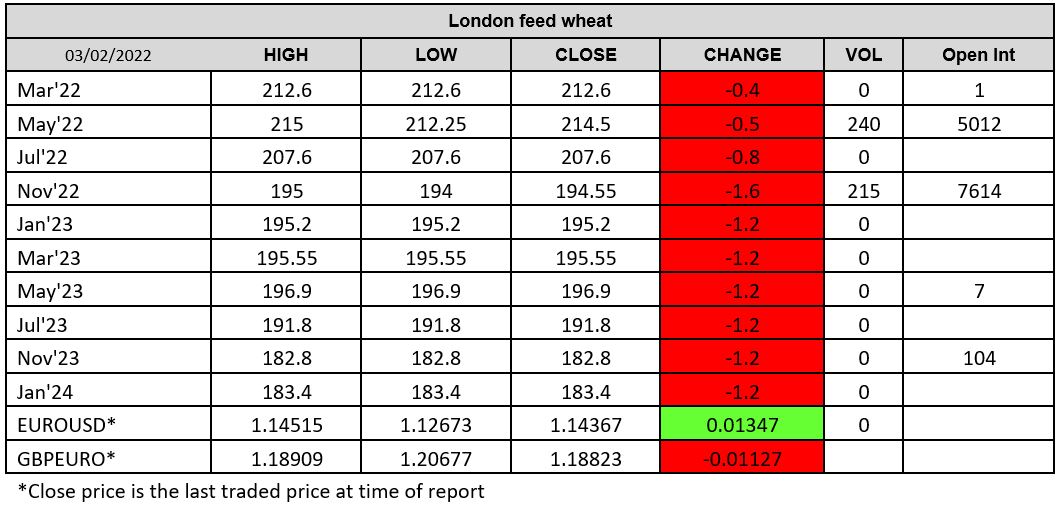

US wheat has fallen $15/t on the week over lack of fresh bullish news over the Russia/Ukraine crisis which leaves markets starved of support. US weekly wheat net sales disappoint, falling 92% to 57,500t. Not a huge amount of chatter on the wheat markets today. Chicago Mar-22 was trading down circa 6-7 cents for most of the day with Matif Mar-22 settling down €3.00 on yesterday at €261.25/t. Matif Mar-22 wheat has slipped to 4 month lows, with minimal bullish news to be shown. Rise in the Euro against the dollar also curbed Matif, maintaining concerns about the pace of western European exports as shipments from the Black Sea region appeared unaffected by tensions over Ukraine. French traders have been keeping an eye on Morocco to see if the drop in demand may stimulate their buying. Rouen shipping data continues to show a flow of wheat loadings for China as well as a rare shipment for Israel. In Germany, standard 12% protein wheat for February onwards delivery in Hamburg was offered for sale at about 13 euros over Matif March-22 following trade at 12 Euros over on Tuesday according to Reuters. Russia has announced the ban on ammonium nitrate exports until 1st April 2022, to ‘cover domestic sowing’. India has started talks with Russia on securing a multiyear fertiliser deal alongside offering to buy fert from Belaruskali in Rupees to get around the FX ban for EUR/USD that Belarus currently has with the sanctions. Sneaky.

USDA today announced the cancellation of corn export sales to China equating to 380kt for the 21/22 marketing year. Rumours then appeared that this cancellation has been misreported for China buying 380kt of soybeans rather than corn. Same group suggest that China may be away from the office to confirm. Who knows. Soybeans turned bearish today after their decent run. There is reason for the speculative length to take profits which does appear to be the case. Supportive story is getting stale now that weather and risk factors have been priced in. Canadian canola prices continue to bubble along over the C$1000 mark but have struggled to touch contract highs. Matif rapeseed started the week strong but has also pulled back in trading since Wednesday. Russia have once again stated that they will implement a higher export tax on sun-oil in March.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston, Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.