London Wheat Report

Source: FutureSource

Markets eased yesterday as news of Russia apparently removing troops from the Ukraine border in Belarus materialised. This morning news reports appeared to say that Russia was not reducing troops but increasing numbers so the threat of war supposedly remains …. Who honestly knows what the Kremlin are up to? Energy complex is higher with Brent Crude trading up 2.5% on yesterday, last trading at $95.71/ba. Brazil’s Agroconsult became the latest agency to cut its soybean production outlooks as the consultancy now expects the country to harvest 125.8Mmt, 6.2% down from the 134.2Mmt of soybeans in the previous estimates. Brazil’s Feb soybean export estimates were once again cut and are now expected at 7.1Mmt, 400kt lower than the previous forecast according to the grain exporters association ANEC. Chicago soybeans were firing on all cylinders today with Mar-22 trading up 27 cents at time of writing around the $15.78 mark. USDA reporting indicated China buying 132kt of new crop beans. Matif rapeseed strengthened further with May-22 settling up €14 on yesterday at €702.25/t.

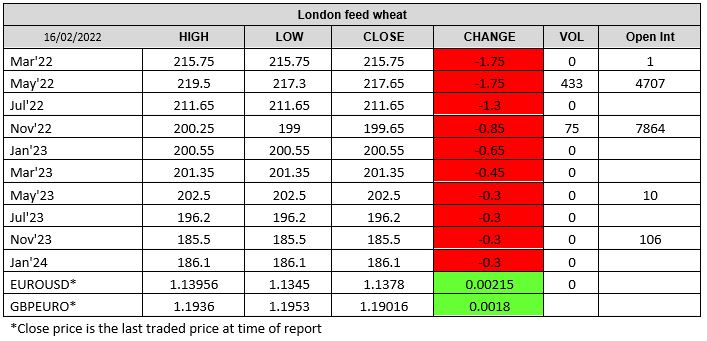

Grains markets were unchanged to lower. Even with the mixed Russian/Ukraine news, there was minimal reaction. Jordan tendered to buy 120kt of milling wheat from optional destinations with deadline for submission 23rd Feb. Syria has not made a purchase in a tender to buy 200kt of milling wheat which closed this week according to European traders. Syria reportedly still needs to import over 1.5Mmt of wheat, primarily Russian origin. FranceAgriMer lowered its forecast of French soft wheat exports outside the European Union in the 2021/22 season to 8.9Mmt from 9Mmt estimated in January. Matif wheat Mar-22 settled down €3.75 on yesterday at €263/t. London followed suit settling lower.

Iran has issued a tender to buy 60kt of corn. Brazilian corn production has been downgraded by 1% to 108Mmt due to the continued prevailing weather conditions. The corn market has ridden the South American weather story for as far as it can take it and now it is very much down to the consumer and how they will react to trade flows over the next 4-6 weeks.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.