London Wheat Report

Source: FutureSource

Tanks, sanctions and a threatening rhetoric from Mr Putin. Markets have very much been led by more Ukraine/Russia headlines. Continued shelling, EU sanctions and American strong words have all heated the market up in today’s trade. News of blood plasma being sent to the front line alongside reports of body bags being ordered and Ukrainian reservists being mobilised offered continued market support. Wheat markets turned hot following on from yesterday. Chicago wheat was trading up, with Mar-22 trading 18 cents up at $8.61/bu at time of writing. Matif wheat May-22 hit a trading high €293/t, up 3% on nearly 3 month highs on the continuing mounting Russia/Ukraine tensions. Black Sea wheat capacity could be reduced by conflict although currently this is primarily speculation. Reports coming in Turkey issued a tender for 435kt of wheat according to traders. Matif Mar-22 settled up €8.50 on yesterday at €287/t

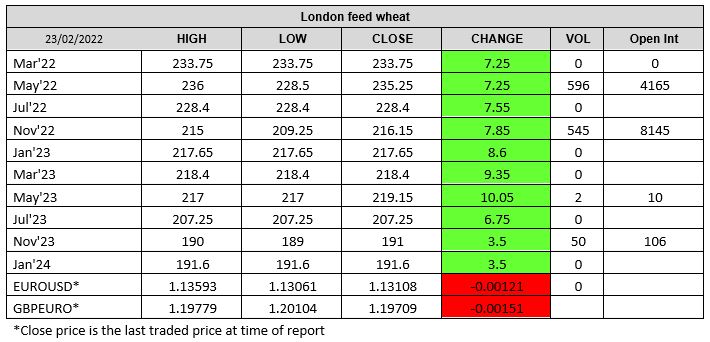

London wheat had a strong trading day, following global markets higher. May-22 hit a trading high of £232/t before settling at £235.25/t, up £7.25 on yesterday. Nov-22 settled up £7.85 on yesterday at £216.15/t.

US sold 132kt of beans to China for 22/23. Brent crude remains strong, trading at $97.27/ba at time of writing. Malaysian palm oil closed above 6,000 ringgit for the first time closing at record highs on the back of firm crude oil, uncertainty of sunflower oil available out of Russia/Black Sea and strong palm demand. Chicago beans were trading up 27 cents at time of writing around $16.62 at time of writing. China is offering resistance to old crop as they look to auction domestic state reserves to meet near demand yet are actively seeking new crop coverage. Matif rapeseed continued to find support, with May-22 settling up €10.75 on yesterday at €740.25/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.