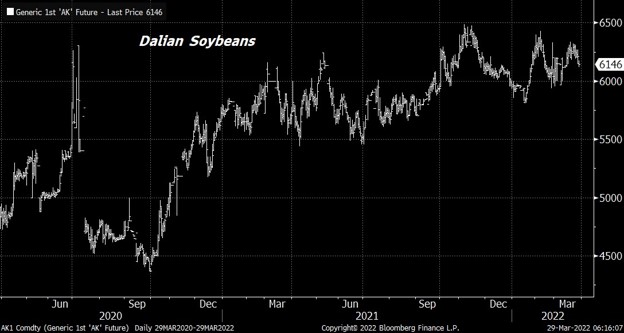

SOYBEANS

Soybeans, soymeal, soyoil and Crude ended lower. May Crude went from $107 to $98 and ended near $104. On Nov,2021, SK was near 12.10. Higher US 20/21 soybean demand and dry South America weather pushed SK to a high last week near 17.36. Some feel at that point price rationed demand especially to China. SK dropped to todays low near 16.22. Some feel this is due to talk of lower China commodity demand. On Dec 15, 2021, BOK was near 51.21. Drop in World rapeseed supplies and Ukraine War slowing their sunoil exports rallied BOK to recent high near 78.58. Today, prices dropped to a low near 70.52.

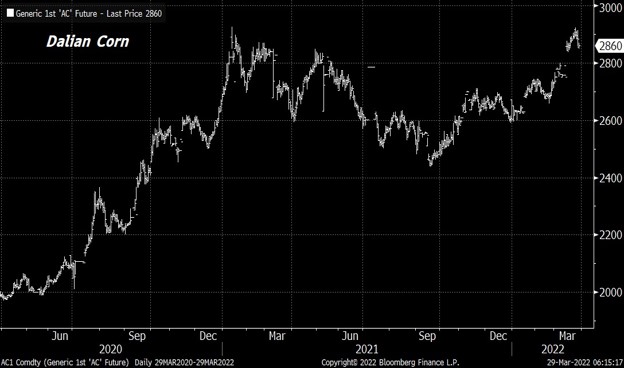

CORN

Corn futures ended lower. On Sep,2021, CK was near 5.12. Higher US 20/21 corn demand, dry South America weather and Ukraine war pushed CK to a high last week near 7.82. Some feel at that point price rationed demand especially to Asian buyers. CK dropped to todays low near 7.13. Some feel this is due to talk of lower China commodity demand and headlines that Russia and Ukraine peace talks today were constructive. Some selling was also due to fact so far, there is little evidence that China will switch 6 mmt of open and unshipped sales from Ukraine to US. This has some worried that US final corn exports may not exceed USDA estimate of 2,500. This could suggest their carryout of 1,440 could also be right. Trade expects USDA to estimate US March 1 corn stocks near 7,877mil bu versus 7,696 last year. Range of guesses is 7,630-8,087. One key will be pct on farm. Some feel US farmer has sold a record amount of their 2021 corn crop to date. USDA will also estimate US 2022 corn acres as of a survey taken March 1. Average trade guess is 92.0 mil acres versus 93.3 last year. Range of guesses is 86.0-93.5. Key could be increase in cost of planting corn especially fertilizer, energy and labor and weather.

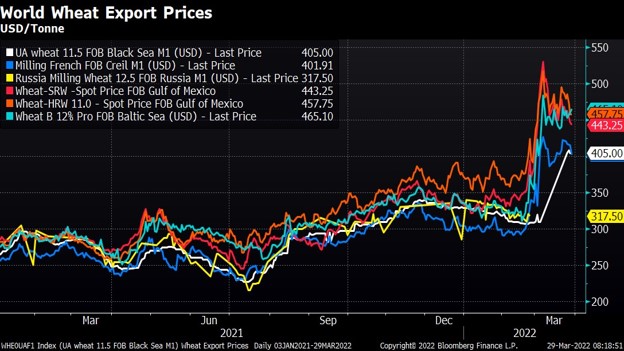

WHEAT

Wheat is still wheat and tough to trade. On Feb,2022, WK was near 7.46. Ukraine war pushed WK to a high near 13.63. Some feel at that point price rationed demand especially to N Africa and Middle east buyers. WK dropped to todays low near 9.72. Some feel this is due to headlines that Russia and Ukraine peace talks today were constructive and Russia troops may be moving from Ukraine capital east. Russia negotiator will take Ukraine proposal to Putin. Russia negotiator later commented that the report did not suggest a ceasefire and that there is a long way for negotiations to go. US 2022 winter wheat crop has seen some moisture but a dry spring and nearby wheat futures are now undervalued. WK ended near 10.14 with a range of 9.72-10.68. One analyst reported that EU will give Morocco, Algeria and Tunisia 200 million euros to counter grain shortages caused by the Ukraine war. There is also talk that this could include EU buying their Crude.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.