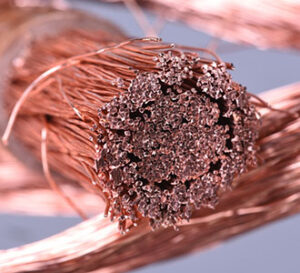

COPPER

In retrospect, the amount of lift in copper prices from the “Asia Copper Week” might have been underestimated with the trade fully embracing long-term demand prospects from renewable energy technology floated at that event. Extending that optimism is a one-year high in copper premiums in China which are nearly 4 times the premiums seen in August. Looking back seeing the Chinese government commit to financially backing its 50 largest real estate companies, might have soothed contagion fears in China but the Chinese copper demand threat clearly remains in place. Unfortunately for the bull camp, estimates for this morning’s existing home sales call for a slight drop but recently copper has not been overly sensitive US economic data with the November rally forged directly in the face of a series of disappointing US readings. However, for the bulls to remain in charge we will need to see a clear dovish tone from the Fed report this afternoon. On a simple technical basis, both the dollar and copper are over-done but dollar fundamentals are distinctly bearish and likely to continue to dominate.

GOLD / SILVER

Asian markets were mixed overnight with Shanghai bursting higher on the back of the government’s plan to provide direct financing to 50 of their largest real estate companies. Hang Seng was down on a big, unexpected jump in its CPI. European shares were mainly down with the DAX treading water. Economic indicators were rather tame to start the Asian session, but the Hong Kong CPI set off a wave of selling in Asia with an unexpected rebound to 2.7%. This was well above the expected 2.1%. In Europe the bright spot was Poland. As Polish PPI dipped deeper into deflation, industrial output jumped back into positive territory for the first time since January. But this bright spot in Europe is fragile and will be tested now that the Germans have imposed a freeze on spending. This is expected to lead to a budget crisis across Germany in the coming weeks, just as America’s debt ceiling has also become a worry. Germany now spends more on climate change and immigration handouts than it spends on its regular government budget. This will all be frozen now. The North American session will start out with the Chicago Fed’s National Activity Index, which is expected to come in at 0.0, and the Philly Fed’s Non-Manufacturing Index which was down -20.3 last month. Later in the morning we will get existing home sales, which are expected to drop slightly to 3.90m. Then in the afternoon the Fed will release its FOMC Meeting Minutes. This is widely seen as the compass for the Fed’s future direct and will be closely observed.

Interested in more futures markets? Explore our Market Dashboards here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.