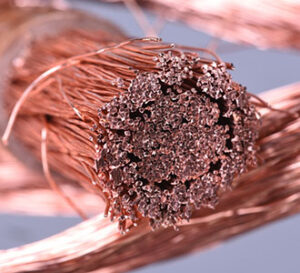

COPPER

In retrospect, the copper market has displayed significant two-sided volatility recently as the outlook for the Chinese economy has waffled between concerning and slightly hopeful. However, the global economic outlook is now softening and therefore economic signals from China have become even more important in determining daily copper prices. Unfortunately for the bull camp, Bloomberg overnight indicated Chinese activity slowed last month (from high-frequency data) with one measure registering below pre-Covid trends. In our opinion, the Chinese economy is very vulnerable because of a lingering threat of financial contagion from real estate. Nonetheless, there are several supply threats from Central and South America lingering and recent Chinese copper import readings have been supportive. Furthermore, the technical picture is positive with a series of higher lows and higher highs unfolding since late October and the copper market continuing to hold a net spec and fund short.

GOLD & SILVER

Given the fundamental and technical events of the last two weeks, the trend in gold and silver has shifted back in favor of the bear camp. From a technical perspective, the massive rally last week exhibited a classic blowoff top and reversal with confirmation from an explosion in trading volume and a subsequent decline in open interest. From a fundamental perspective, the mainstay of the bull case in precious metal markets since October has been a weakening dollar which now appears to have recovered especially with the market’s decision that despite signs of US slowing, the US will likely hold up better than most in the face of the lagged headwinds from the unprecedented rate hike cycle. However, the upward track in the dollar does not look to be as aggressive as was seen last summer and it is possible that falling implied treasury yields will help cushion gold and silver against $ liquidation pressure. Looking ahead to this week’s economic slate, the trade will be presented with another round of US treasury auctions which have become more volatile because of their expanding size. It should be noted that the week ahead will also bring US CPI and PPI readings which will add considerably to (or subtract from) the prospects of a US rate cut early next year. Fortunately for the bull camp, this week’s US CPI and PPI readings are expected to signal moderating inflation with expectations for both reports calling for a gain of only 0.1%! In conclusion, the initial path of least resistance is down with technical stop loss selling momentum likely to control until after the US CPI report on Tuesday morning. The silver market is presented with nearly the same bearish fundamental and technical picture as gold, with added fundamental bearishness seen from the threat of sagging physical demand because of sagging global industrial activity. Like gold, the silver market is also overbought in spec and fund positioning, with the latest COT report registering the biggest net spec long since July.

Interested in more futures markets? Explore our Market Dashboards here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.