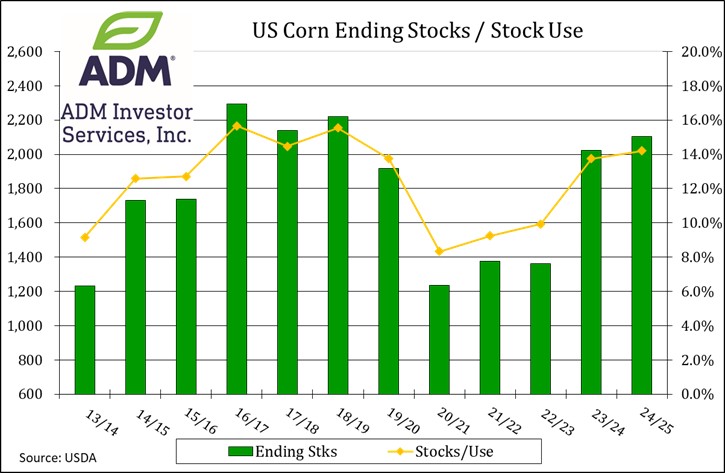

CORN

Prices were up $.03-$.05 as markets appear to be building in additional weather premium. As we expected no changes to US corn balance sheet for either 23/24, or 24/25 MY. Old crop stocks were left at just over 2.0 bil. bu. and 2.1 bil. for new crop. 23/24 world stocks at 312.4 mmt and 310.8 mmt for 24/25 were both in line with expectations. EIA data showed ethanol production slipped to 300.7 mil. gallons LW, down from 315 mil. the previous week. Corn usage at 102.5 mil. bu. was well below the pace needed to reach the USDA usage forecast of 5.450 bil. bu. A strong close enable July-24 to close above both its 50/100 day MA’s however held below yesterday’s high of $4.56 ¼. Dec-24 corn is hovering just below 100 day MA resistance at $4.72 ¼. Export sales tomorrow are expected to range from 28 – 56 mil. bu.

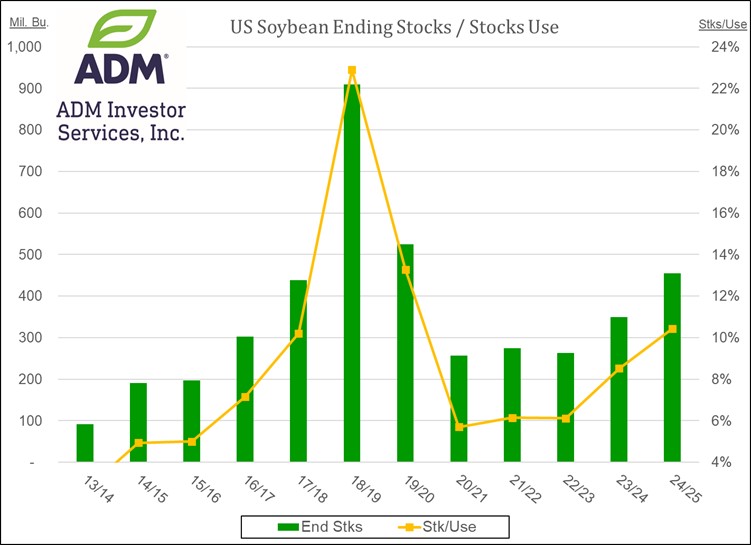

SOYBEANS

The soybean complex finished mixed as spreads firmed. Beans were down $.01-$.05 led by July-24, meal was mixed from up $1 in July-24 to down $2, while oil was up 5-15. July-24 beans violated support at $11.74 intraday before recovering. July-24 meal held a test of its 50 day MA at $358.20. Much above normal temperatures are expected to expand across much of the nation’s midsection for the next 10-14 days. With only scattered showers for the southern Midwest and ECB over the next 7 days, a rapid drawdown in soil moisture is likely. Moderate to heavy rains are expected to fire along the NW flank of the high pressure ridge resulting the NW half of the corn and soybean bean to receive healthy rainfall totals by early next week. 2023/24 soybean stocks rose 10 mil. bu. to 350 mil. due to lower crush, in line with our expectation for a 15 mil. bu. cut in crush. Exports for now held steady at 1.70 bil. bu. The higher 23/24 stocks carried right thru to 10 mil. higher for 24/25 up to 455 mil., also in line with expectations. Domestic bean oil usage was cut 200 mil lbs. (not due to biofuels) while exports rose 100 mil. lbs. Bean oil production was lowered slightly due to the lower crush forecast. Lot of changes to the 23/24 meal balance sheet with production down 250 thousand tons, imports up 50, domestic use down 500, while exports were increased 200. Brazil 23/24 crop was only lowered 1 mmt to 153 mmt. Global stocks at 111 mmt for 23/24 and 128 mmt for 24/25 were both in line with expectations. Markets again are unimpressed with another 106k mt of beans sold to China, total of 314k mt (11.5 mil. bu.) sold to China since last Fri. Spot board crush margins improved $.04 to $.96 ½ bu. Export sales tomorrow are expected to range from 5-25 mil. for beans, 200-500k tons meal, and 0-20k tons oil.

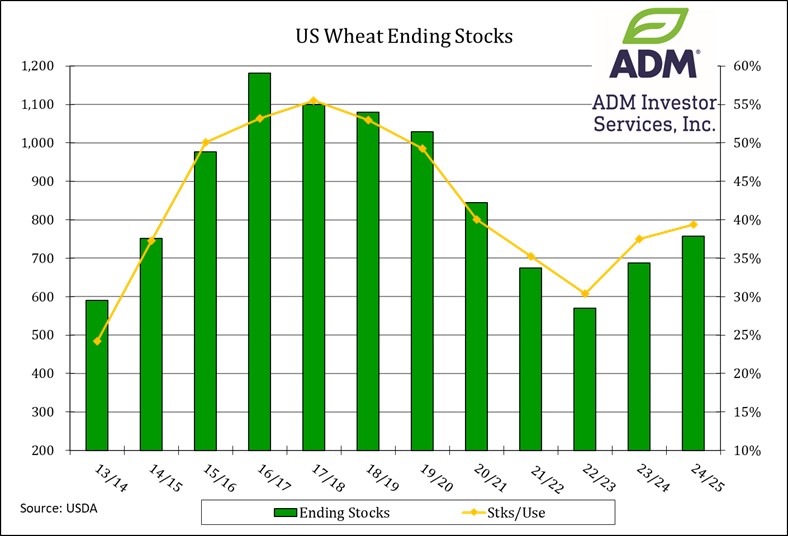

WHEAT

US winter wheat production rose 17 mil. bu. to 1.295 bil. exactly in line with our pre-report estimate. HRW wheat production rose 21 mil. to 726 mil. while SRW was down 2 mil. to 342 mil. with white wheat production down 3 to 226 mil. Old crop ending stocks were left unchanged at 688 mil., in line with expectations. The old crop export forecast at 720 mil. still seems a bit lofty to me. The higher WW production was more than offset by at 25 mil. bu increase in 24/25 exports resulting in ending stocks falling to 758 mil. roughly 25 mil. below expectations. The revised export forecast at 800 mil. bu. if realized would be the highest in 4 year. Global stocks for 23/24 were revised up nearly 2 mmt vs. expectations for unchanged. New crop 24/25 ending stocks are forecast to slip to 252 mmt, in line with expectations. The USDA cut Russia’s wheat production 5 mmt to 83 mmt, and lowered Ukraine’s by 1.5 mmt to 19.5 mmt. The lack of a meaningful recovery in wheat prices suggests the market is anticipating higher production est. for US WW in subsequent reports.

Charts provided by QST.

>>See more market commentary here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.