London Wheat Report

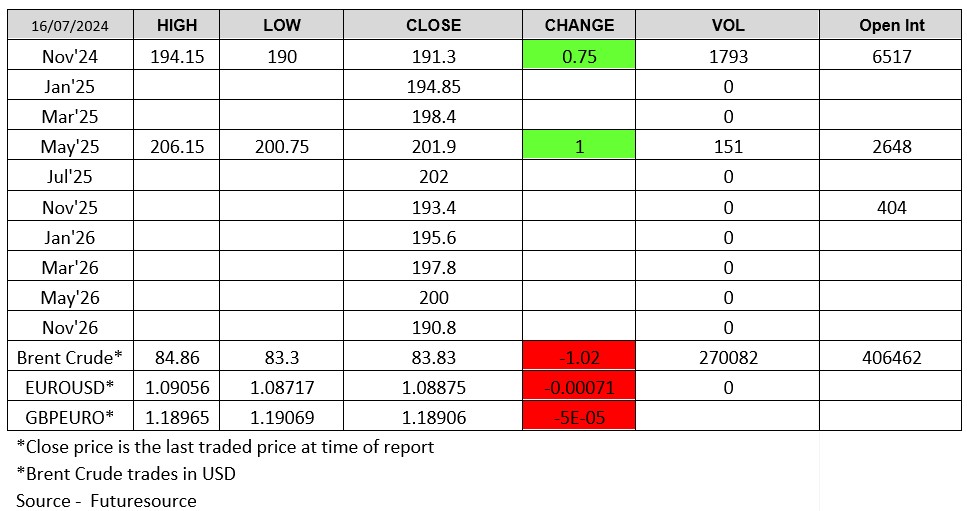

After a heavy day in the red yesterday, it looks as though there has been some degree of turn around with the front month in London Wheat closing 191.30 and Matif Wheat 214.25 given strong buy levels across the board.

Contrary to yesterday’s IKAR estimates (increasing wheat outputs from 83mnt to 83.2mnt), the Rostov region which accounts for 11% of Russia’s total grain harvest, is battling to save its harvest. Given Russia’s position as top global wheat exporter, this could yet throw grain markets into disarray once again. To confuse prices yet further, progress on the winter wheat harvest in the US is better than average (74% harvested so far this year compared to 62% over a 5-year average for the same date). This may go some way to negate Russia’s woes.

Matif Rapeseed is perhaps the most notable gain in today’s trading, posting its first day in the green since the 5th of July. It has shed north of 41 Euros/T over this time. It only gained a Euro across the curve today so still plenty of value to recover although it does raise the question: could this be the hallowed turn-around-Tuesday we have been waiting for?

Source: Refinitive

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Ryan Easterbrook, Aaron Stockley-Isted and Jamie Kirkwood

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.