GOLD

December gold futures are higher and are above the psychological 2500 level. The metal continues to benefit from its status as a safe-haven asset in light of increasing tensions in the Middle East. Futures are holding up well despite recent strong U.S. economic data, which reinforced the case for a less aggressive monetary policy by the Federal Reserve in its widely anticipated interest rate cut in September. However, the Federal Open Market Committee still appears to be on track to lower its fed funds rate at its September 18 policy meeting by 25 basis points.

The main trend for gold is higher.

SILVER

Yesterday September silver futures advanced above a major downtrend line that started in mid-July. However, some of those gains are being given back today. Underlying support remains due to expectations that the Federal Reserve will pivot to accommodation in September. Data released this week showed that both producer and consumer prices in the U.S. were relatively tame in July.

Prospects of a weakening global economy are feared to limit demand for silver.

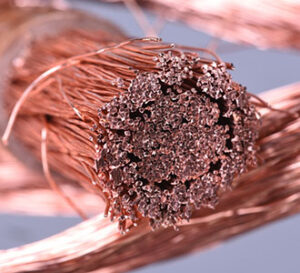

COPPER

September copper futures trended higher over the past two weeks due to supply disruptions. However, prices are lower today on news that a labor dispute at the world’s largest copper mine in Chile, which threatened to disrupt more than 5.0% of global supply, has been settled.

There was additional pressure today on news that housing starts in the U.S. in July were 1.238 million when 1.342 million were expected on an annualized basis, and annualized building permits were 1.396 million when 1.430 million were anticipated.

Interested in more futures markets? Explore our Market Dashboards here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.