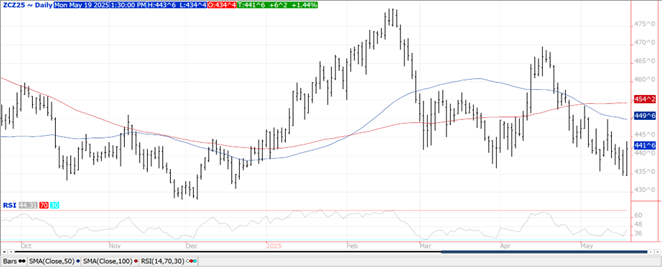

CORN

Prices surged late closing $.04-$.07 higher. Nearby spreads weakened while deferred spreads firmed a touch. Dec-25 futures plowed thru Friday’s high in late trade. Inside trading session for July-25. US weather saw rains continued to linger in the N. plains and WCB this weekend. NE was able to pick up anywhere from .50” to 2+” of much needed rainfall. Widespread rains ranging from .75” to as much of 3+” is expected across the central Midwest and ECB this week. Some of the late seeded crops across the Southern and eastern Midwest will fall behind their historical averages with some areas prone to flooding. Export inspections rebounded to 68 mil. bu., at the high end of expectations and above the 46 mil. bu. needed to reach the revised USDA forecast of 2.60 bil. bu. The previous week’s inspections were revised up by 3 mil. bringing YTD inspections to 1.793 bil. up 29% from YA vs. the USDA forecast of up 13%. Largest takers were Mexico with 19 mil. and Japan with 11 mil. Money manager sold nearly 99k contracts LW, flipping their position to net short 85k, their largest short in 7 months.

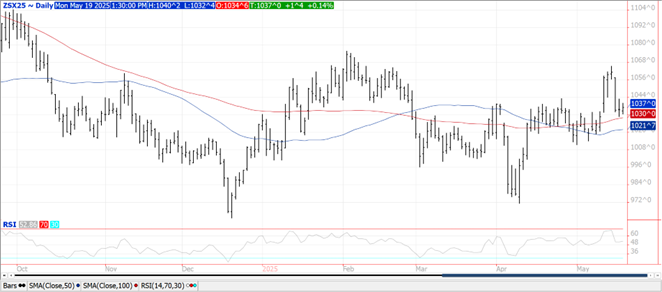

SOYBEANS

Prices were mostly higher with beans up $.01-$.03, bean oil was up 50 points while meal was a $1 lower. Spreads across the complex were mixed. July-25 beans traded below LW’s low and 100 day MA support however failed to see follow thru weakness, enabling prices to recover. Inside trade for Nov-25 beans. Also an inside session for July-25 oil. Fresh 6 week low for July-25 meal however still holding above its contract low at $289.70. Meal prices are weaker despite the USDA announcing the sale of 145k mt to the Philippines. Spot board crush margins rebounded another $.03 to $1.33 ½ bu. with bean oil PV inching up to 45.9%. The US $$$ was sharply lower however settled well off session lows. The weakness was largely driven by Friday’s downgrade of US credit to Aa1 from Aaa by Moody’s. Export inspections at 8 mil. bu. were below expectations and a MY low. They were also below the 13 mil. needed to reach the revised USDA forecast of 1.850 bil. bu. YTD inspections at 1.622 bil. are up 11% from YA vs. USDA forecast of up 9%. Egypt was the largest taker with 2 mil. bu. MM’s were moderate to lite buyers across the soybean complex LW.

WHEAT

Prices are higher across all 3 classes today ranging from $.04 higher in CGO to $.12 higher in MGEX. Export inspections at 16 mil. bu. were in line with expectations however below the 24 mil. needed to reach the USDA forecast. YTD inspections at 761 mil. are up 16% from YA, in line with the USDA forecast. Saudi Arabia did buy 621k mt of wheat in Friday’s tender. Prices ranged from just below $248 to $256/mt CF for late summer to early fall delivery. Much of this wheat is expected to be sourced from the Black Sea region. Russia’s Ag. Ministry lowered their wheat export tax 11.7% to 1,550 roubles/mt.

Charts provided by QST.

>>See more market commentary here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.