London Wheat Report

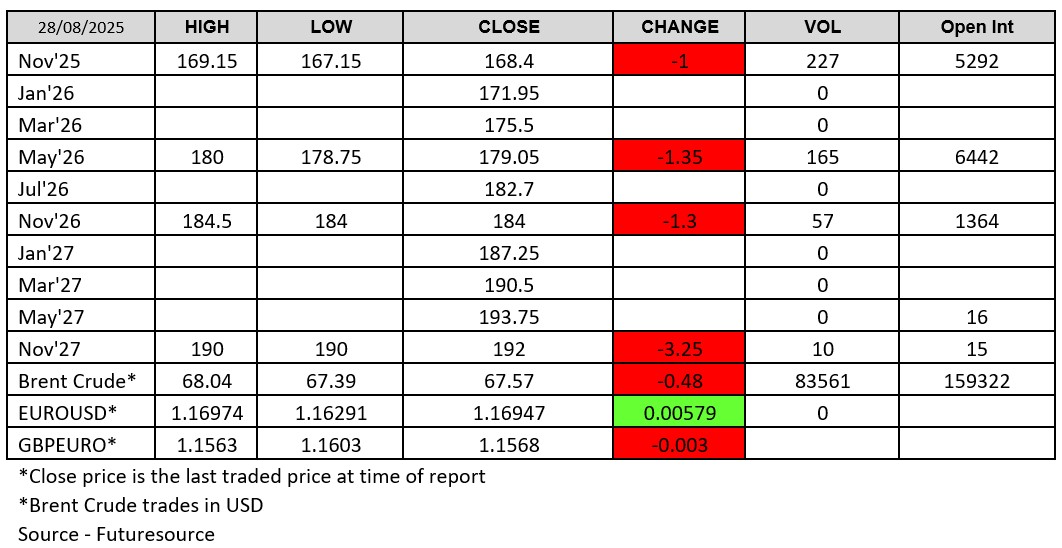

A quieter day in London, which was wet again today, as prices resumed their slip further into the red. Volumes were fairly thin on the ground across all traded London wheat contracts, with the Nov-27 London contract trading down to £190.

The main culprit for the fall, the Chicago wheat contract, extended its fall to a new one-week low today as expectations of bumper supplies continued to weigh on sentiment. Wheat prices are facing renewed headwinds amid higher production forecasts in major exporting countries, in addition to expected rainfall across the U.S. winter wheat-growing areas in the coming days.

Down under, Australia is reportedly on track to produce between 32 mmt and 35 mmt of wheat in its upcoming harvest. Estimates were raised in the forecast after an improvement in crop conditions, as analysts stated they could further upgrade their figures given the expected growing conditions to come.

Across in Europe, it was reported today that France’s wheat exports to destinations outside the EU should rebound steeply in 2025/26 from last season’s low. However, the country could still face its biggest stockpile in 21 years, owing to the prospect of prices holding below production costs halting many producers from selling. As the European Union’s biggest grain producer, France has just completed its harvest for this year, which analysts estimate to be around 33.4 mmt, up 30% from a rain-drenched crop of 2024. The poor previous harvest had contributed to the lowest non-EU exports this century in 2024/25 at 3.5 mmt.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Ryan Easterbrook, Aaron Stockley-Isted and Jamie Kirkwood

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.