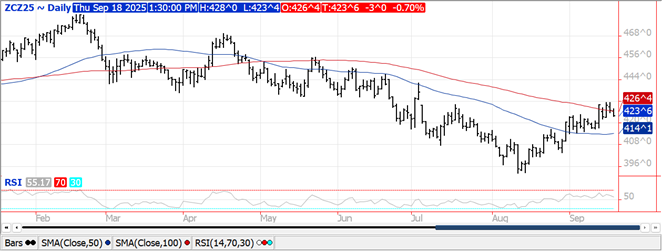

CORN

Prices were $.03 lower closing near session lows in 2 sided trade. Spreads were mixed and little changed. Dec-25 closed back below its 100 day MA however held above this week’s low of $4.22. The Trump Admin. and Congress are reportedly working on an aid package for US farmers as they face another year of operational losses given the high input costs and low prices. Export sales at 49 mil. bu. were in line with expectations. YTD commitments for the 25/26 MY at 938 mil. are up 68% from YA, vs. the revised USDA forecast of up 5%. Commitments represent 31.5% of the USDA forecast above the historical Ave. of 25.5%. Noted buyers were Mexico – 16.5 mil., while S. Korea and Japan bought 8 mil. bu. each. The USDA also announced the sale of 110k mt (4.4 mil. bu.) to Mexico. Conab is forecasting Brazilian corn acres for 2025/26 at 22.6 mil. HA, up 3.2% from YA with production at 138.3 mmt. The USDA is using the same acreage forecast however production at only 131 mmt. Conab is assuming record yields. US corn acres in drought surged 12% this past week to 25%, the highest since April-25.

SOYBEANS

Prices were lower across the complex with beans down $.06, meal was off $1 while oil has backed up 60-65 points. Spreads were mixed and little changed. Nov-25 beans slipped to a new low for the week with next support at the 100 day MA at $10.30 ¾. New low for the week in Oct-25 oil as well with support at LW’s low of 49.44. Oct-25 meal held support at its 50 day MA at $281.30. Spot board crush margins slipped another $.01 to $1.53 ½ with bean oil PV slipping to 47.4%. The favorable weather outlook in SA leans bearish for prices. Rains in Argentina and S. Brazil remain timely. Scattered rains are also expected to start filling in across EC growing areas of Mato Grosso and MGDS by the end of Sept. bringing an end to their dry season as farmers prepare to plant a record amount of soybeans. Exports at 34 mil. bu. were in line with expectations. YTD commitments for the 25/26 MY at 378 mil. bu. are down 36% from YA vs. the revised USDA forecast of down 10%. Commitments represent 22% of the USDA forecast vs. the historical Ave. of 37%. Still no sales to China. Noted buyers were Egypt – 8 mil. bu. while Mexico and Spain purchased 6-7 mil. bu. each. Soybean meal sales at 182k tons were at the low end of expectations. Old crop commitments are up 13% from YA, in line with the revised USDA forecast. Bean oil sales at 49 mil. lbs. brought 24/25 commitments to 2.467 bil., lbs. closing in on the revised USDA forecast of 2.50 bil. Conab is forecasting Brazilian bean acres for 2025/26 at a record 49.1 mil. HA, up 3.6% from YA with production also a record 177.7 mmt. Conab and the USDA are both forecasting Brazilian soybean exports at 112 mmt, up from 106 mmt in 24/25. US bean acres in drought jumped 14% this past week to 36%, the highest since March-25.

WHEAT

Prices ranged from $.03-$.06 lower across the 3 classes in 2 sided trade. Spreads were slightly weaker. US rains will likely not impact corn or soybean yields however will help restore soil moisture in drought stressed areas, beneficial for the winter wheat crop that is currently being planted. Exports at 14 mil. bu. were in line with expectations. YTD commitments at 481 mil. bu. are up 20.5% from YA, vs. the revised USDA forecast of up 9%. Commitments represent 53.5% of the USDA forecast vs. the historical average of 51%. By class commitments vs. the revised USDA forecast are: HRW up 111% vs. USDA up 49%, SRW up 3% in line with the USDA, HRS down 11% vs. down 4%, and white down 10% vs. down 14%. US winter wheat area in drought increased 6% last week to 44%, a 10 month high. EU grain group COCERAL is forecasting combined EU and UK soft wheat production at 147.4 mmt, up from 143.1 mmt in July. Wire services are reporting Iran’s wheat purchase this week from Russia was likely much higher than previously expected. Volume estimates range from .5 mmt to 2.0 mmt with shipment in Q4 of this year. The IGC raised their 2025/26 global wheat production forecast 8 mmt to 819 mmt, just above the revised USDA forecast of 816.2 mmt.

Charts provided by QST.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.