CORN

Prices finished $.01 higher in choppy 2 sided trade. Spreads were mixed and little changed. Dec-25 closed back above its 50 day MA after trading below the September low overnight. Prices recovered in sympathy with higher soybeans following Pres. Trumps midday social media posts. Next support is at $4.00 followed by the contract low at $3.92. With old crop stocks now well over 1.5 bil. bu., the feed usage forecast from 24/25 MY is likely more than 200 mil. bu. too high. This lower usage will also carry into the 25/26 MY as well as cattle inventories remain low with the lack of feeders coming in from Mexico due to the screwworm problem. At this point nobody knows when we’ll get our next production update with the USDA Fed. Govt. on day 1 of the shutdown. Ethanol production from the EIA which slipped to 292 mil. gallons, down from 301 mil. the previous week and down 2% from YA. Production the lowest in 4 ½ months and below expectations. There was 99 mil. bu. of corn used in the production process, or 14.16 mil. bu. per day, well below the 15.4 mbd needed to reach the USDA corn usage estimate of 5.60 bil. bu. Ethanol stocks slumped to 22.8 mil. barrels, at the low end of expectations and below YA at 23.5 mb.

SOYBEANS

Except for Oct-25 meal, prices were higher across the complex with beans up $.11, meal was mixed and within $1 of unchanged while oil jumped 80-90 points. Bean spreads firmed while product spreads were mixed. Nov-25 beans traded to a fresh 7 week low before the Pres. timely social media post. The range in Nov-25 beans at just over $.26 was also the widest in 7 weeks. Resistance is at the 50 day MA at $10.24 ½. New CL for Dec-25 meal before the midday recovery. Deliveries against Oct-25 meal jumped to 207 contracts, while oil settled back to 425, down from 454. Spot board crush margins were mostly steady at $1.43 ½ bu. while bean oil PV improved to 48%. Pres. Trump stated on Truth Social that China was not buying for “negotiating reasons” and that soybeans will be a “major topic of discussion” during his meeting with China’s Pres. Xi in 4 weeks. Just a reminder of how sensitive prices will be to news or comments surrounding Chinese demand, or lack thereof. Without Chinese buying the current USDA usage forecasts appear optimistic. No monthly census crush data today due to the Fed. Govt. shutdown and no export sales tomorrow. Yesterday EIA report showed combined biodiesel and RD production rose 2.8% in July to 420 mil. gallons, still down 8% YOY. Bean oil usage for biofuel production rose 6% from the previous month to 1.108 bil. lbs. however still down 2.7% from July-24. YTD usage for the 24/25 MY at 9.585 bil. lbs. is down 10.4% YOY vs. the USDA est. of down 5.7%. The current USDA usage forecast at 12.250 bil. lbs. is too high.

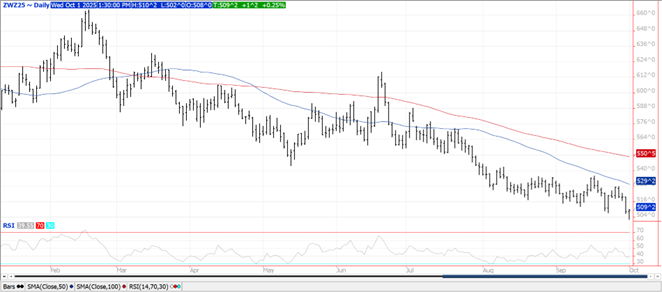

WHEAT

Prices ranged from down $.06 in MIAX to up $.01 in CGO. New contract lows across the 3 classes on early weakness. Dec-25 CGO continues to hold support above the $5 level. Secondary support is at $4.94 ½. Support for the KC weekly is at $4.80. Sept 1st wheat stocks at 2.12 bil. bu. was 77 mil. above the average trade guess and largely due to this year’s production increasing 58 mil. bu. to 1.985 bil., 35 mil. above the range of guesses. The increase largely due to winter wheat acres being revised up nearly 775k, with most of those acres coming from TX and KS. The percentage of acres harvested for grain rose to 77%, still below YA and historical average of 78%. The WW yield was little changed at 54.9 bpa, just below the record yield of 55.3 bpa in 2016. Prior to yesterday report, in the past 15 years, the September report saw production increase only 2 times while being cut 13 times. Spring wheat production at 497 mil. bu. was also above expectations.

Charts provided by QST.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.