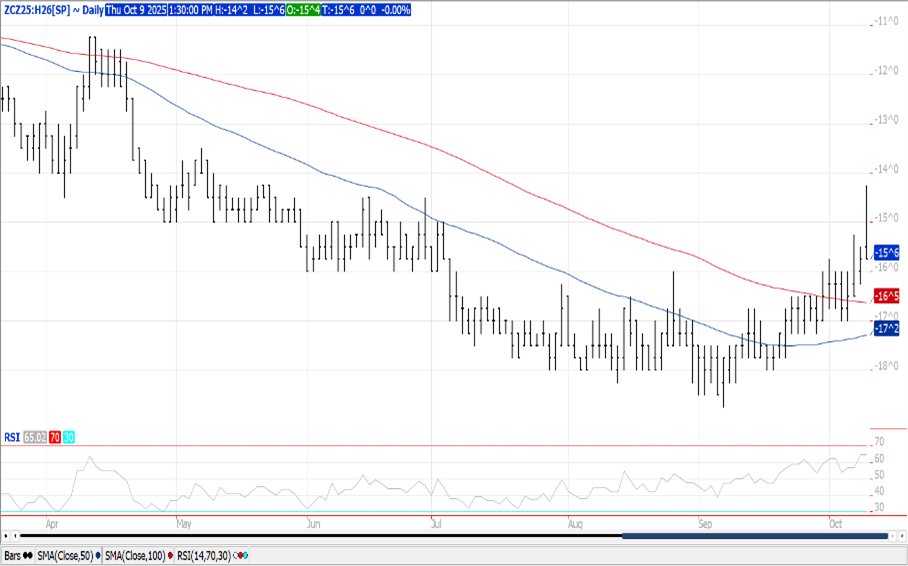

CORN

Prices are $.03 – $.04 lower making session lows near the close. Early strength in spreads also were not able to hold closing slightly weaker. Despite the late selloff Dec-25 remains stuck between its 50 and 100 day MA’s. US corn at the Gulf is about $.20-$.25 bu. FOB discount to Brazil into early next year which should continue to drive global demand to US grain. China’s Ag. Ministry lowered their 2025/26 corn import est. 1 mmt to 6 mmt, well below the USDA forecast of 10 mmt. Despite expectations for US ending stocks to swell to over 2.20 bil. bu. prices have held in surprisingly well this harvest season. Bulls would argue lower production and strong export demand will more than offset weak feed usage enabling stocks to fall below 2.0 bil. Bears would argue growing supply pressure will eventually weigh on prices forcing a retest of the $4.00 level. There is still some uncertainty on Brazil’s 2024/25 production with the USDA est. at 135 mmt still well below Conab’s at 139.7 mmt.

SOYBEANS

Late weakness caused prices to close lower across the complex with beans down $.04-$.07, meal was down $1 while oil is down 55 points. Bean and meal spreads weakened while oil spreads were slightly higher. Nov-25 beans failed to trade above yesterday’s high at $10.30 while also rejecting yesterday’s close over its 100-day MA. Prices were able to hold above yesterday’s low however. Fresh 3 week high for Dec-25 oil overnight before pulling back. Inside trade for Dec-25 meal as prices remain stuck between $275-$280 this week. Today’s weakness largely driven by reports China is now requiring export licenses for the sale of rare earth metals citing national security reasons. The tightening control by China has raised tensions ahead of the expected meeting between Pres. Trump and Pres. Xi later this month in S. Korea. Pres. Trump today reiterated his desire to discuss US soybeans with Pres. Xi. Spot board crush margins set back $.01 to $1.47 bu. with bean oil PV slipping just below 48%. US soybeans at the Gulf remain at about a $1 bu. FOB discount to Brazilian offers into the end of the year reflecting the import tariff differential into China. Brazilian soybean exports in Oct-25 are expected to reach 7.1 mmt, a record high for the month and 51% above Oct-24. I’d expect US demand to non-Chinese importers to remain strong. We had speculative traders net buyers of 4,000 – 5,000 contracts each of beans and oil yesterday while buying a couple thousand meal. We have MM’s net short around 115k contracts of meal while flipping their position to net long a few thousands soybean and oil. India’s Ag. Ministry expects they will need to import an additional 5.3 mmt of palm oil in 2026 to implement raising their biodiesel blending up to 50% from the current 40%. The Rosario Grain Exchange is forecasting 2025/26 Argentine soybean production to reach 47 mmt, below the USDA forecast of 48.5 mmt.

WHEAT

Prices ranged from $.04 lower to $.02 higher across the 3 classes, unable to hold overnight strength. Prices were however able to hold above recent contract lows. Early strength was attributed to reports Russia’s winter wheat plantings will fall 6.2% YOY to 28.2 mil. HA, this due to reduced profitability in growing wheat while shifting acres to oilseed. Expana raised their EU production forecast .3 mmt to 136.4 mmt, below the USDA est. of 140 mmt.

Charts provided by QST.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.