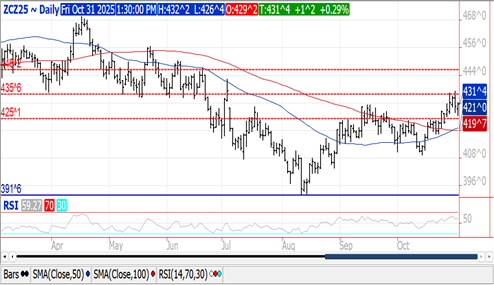

CORN

Prices were steady to $.01 higher while spreads firmed. Dec-25 held support above this week’s low at $4.26. Secondary support is at the 100 day MA at $4.20. This week’s high at $4.37 was near the 50% retracement from the Feb. high to the Aug low. We estimate speculative traders bought 3k contracts yesterday cutting their short position to around 67k contracts. The BAGE report Argentine corn plantings have advanced to 35%. While prices were higher for the week, corn has underperformed vs. soybeans with the lack of trade interest from China. Although exports to other countries has been strong along with usage for ethanol production, it’s difficult to envision a scenario for US 25/26 stocks falling below 2.0 bil. bu. unless US yields slip below 180 bpa from the current record 186.7. We may have to wait until Jan-26 before our next production and WASDE updates.

SOYBEANS

Prices were mixed as beans were $.08-$.10 higher closing at session highs, meal was up another $6 while oil dropped nearly a full $.01 lb. Beans spreads were mixed while product spreads were slightly weaker. Jan-26 beans closed into a fresh 13 month high up $1.15 bu. from the August low. Dec-25 oil fell to a 4 ½ month low with next major chart support at 46.55. Dec-25 meal surged to its highest level in nearly 9 months. With the 4 additional cargoes off the PNW, China’s US beans purchases this week are up to 7 cargoes. Total volume is roughly 430k tons or nearly 16 mil. bu. They need to buy just over 33 mil. bu. every week thru the end of Jan-26 to reach 12 mmt. In the past decade, on average China has bought just over 27 mmt of US beans annually. Speculative traders likely stretched their long position in soybeans to over 80k contracts today which would be their largest long position in nearly 2 years. The MM’s short position in meal is likely down to 70k contracts. Combined biodiesel and renewable diesel production plunged 10% in Aug-25 to 378 mil. gallon and is down 17% YOY. Combined biodiesel and RD capacity rose 3.4% to a record 6.964 bil. gallons annually, with all the increase in RD. Bean oil usage for Aug-25 fell 6% to 1.041 bil. lbs. bringing cumulative usage in the first 11 months of the 24/25 MY to 10.626 bil. lbs.

WHEAT

Prices rallied late closing $.08-$.11 higher in KC and CGO while MIAX was up $.02. The late strength likely all technically driven. Dec-25 CGO and KC contracts both held support near their respective 50 day MA’s, while both held below yesterday’s high. Spreads in both CGO and KC firmed while holding steady in MIAX. The BAGE reports Argentine wheat harvest advanced to 8%. While they held their production forecast unchanged at 22 mmt, well above the USDA’s 19.5 mmt estimate, they did point out that the recent cold snap may have impacted the crop in the south indicating the consequences will become clearer in coming days. Ukraine’s Grain Ministry states they have harvested 22.8 mmt of wheat, very near the USDA production forecast of 23 mmt. Analysts est. Russia’s wheat exports in Oct-25 will reach between 5.1-5.5 mmt, vs. 5.6 mmt in Oct-24.

Charts provided by QST.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.