CORN

Prices were steady to $.02 ½ higher with bear spreading noted. The Dec/Mch spread widened to a 2 week low at -$.15 ahead of Friday’s FND. As of yesterday there were 80 contracts registered with the CME for delivery. Inside trade for Dec corn as it consolidates between its 100 day MA support at $4.19 ½ and the 50 day MA resistance at $4.30 ¼. Exports for the period ending Oct. 9th at 52 mil. bu. brought YTD commitments to 1.210 bil. bu. up 55% from YA vs. the USDA forecast of up 9%. Shipments at 313 mil. were up 60% YOY. US exports should remain strong as prices remain competitive in the global marketplace with offers $.30-$.35 below Brazil thru Mch-26. US harvest at 96% up from 91% LW however behind the 5-year Ave. of 97%. EU 25/26 corn imports as of Nov. 21st at 6.45 mmt are down 21% YOY.

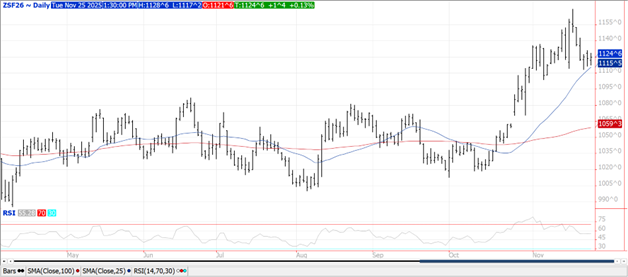

SOYBEANS

A late recovery in bean oil enabled prices to close higher across the complex. Beans were $.02-$.04 higher, meal was up $2-$3 while oil rose 10-15 points. Bean spreads weakened, oil spreads were mixed while meal spreads firmed. Inside trade for Jan-26 beans as it holds support just above its 50 day MA at $11.15 ½. The early rally in Dec-25 meal was capped at $320 ton. Inside trade for Dec-25 oil as it closed near session highs close to its 50 day MA. USDA Ag. Sec. Rollins insists a farmer financial aid package will be announced within a couple of weeks while maintaining that China will buy 12 mmt of US beans in the 25/26 MY. She also hinted the signing of a formal trade agreement with China could also take place within a few weeks. Despite no new flash sales this AM, leaving announced sales to China at just over 1.9 mmt, Sec. Bessent today stated Chinese purchases of US beans were “right on schedule”. Spot board crush margins recovered $.05 today to $1.37 ½ with bean oil PV holding just above 44%. While US spot FOB offers at the Gulf remain competitive with SA, Brazilian FOB offers for Jan-26 shipment are roughly $.50 bu. below US offers. That spreads widens to over $1 bu. by March which in my view will likely prevent large scale Chinese purchases of US beans. There were 338 contracts registered for delivery against Dec meal and 765 for oil. Bean sales at 29 mil. bu. brought YTD commitments to 499 mil. bu. down 36% from YA vs. the current USDA forecast at down 13%. As of Oct. 9th still no commitments to China. Shipments at 133 mil. bu. were down 32% YOY. Meal sales at 358k tons brought YTD commitments to 5,123k tons down 1% YOY vs. the USDA export forecast of up 5%. EU 25/26 soybean imports as of Nov. 21st at 4.66 mmt are down 14% YOY. Meal imports at 7.02 mmt are down 10%.

WHEAT

Prices were $.04-$.12 higher across the 3 classes today. Inside trade for Dec-25 CGO. Dec-25 MIAX surged thru its 100 day MA however stopped shy of its November high at $5.84 ½. Spreads firmed across all 3 classes. US winter wheat plantings at 97% were in line with YA and the 5-year Ave. Crop ratings improved 3% to 48% G/E, still below the 55% from YA. As of yesterday there was 34 contracts registered for delivery against SRW wheat and 176 for HRW. Exports at 23 mil. bu. brought YTD commitments to 568 mil. bu. up 25% from YA, vs. the USDA forecast of up 9%. Shipments at 382 mil. bu. were up 20% YOY. EU 25/26 soft wheat exports at 9.2 mmt are down 5% YOY. IKAR expects Russian wheat production to range from 86-91 mmt in 2026.

Charts provided by QST.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.