Base Metals

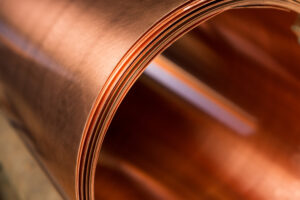

Copper: Copper prices remained higher despite dropping following the ADP payroll data as tight supply concerns continued to offer support for prices. Benchmark three-month copper on the LME was up 1.8% at $11,347 earlier in the morning after touching a record high of $11,434.50. LME data showed net fresh cancellations of 50,725 tons in warehouses in Asia on Tuesday, bringing available LME copper stocks to their lowest since July at 105,275 tons. Glencore also lowered its 2026 copper production guidance to a range with a midpoint of 840,000 tons for 2026, down from 930,000 previously. The LME cash copper premium over the three-month contract was last at $86.5 a ton on Wednesday, its highest since mid-October, indicating tightness in near-term supply. The Comex copper premium over the LME benchmark is also continuing to attract flows into the US as Comex stocks repeatedly hit record highs. Goldman Sachs on Wednesday lifted its average LME copper price forecast for the first half of 2026 to $10,710, up from $10,415.

ISM Manufacturing PMI data out of the US showed that manufacturing conditions in the US continue to remain subdued, with the index falling to 48.2 in November from 48.7 in October. The reading posted the ninth straight month of a contraction in activity as deliveries, new orders, and employment fell. Price pressures also grew, with the prices index rising, although it remained below highs seen in the late spring and summer. Meanwhile, the RatingDog China General Manufacturing PMI fell to 49.9 in November from 50.6 in October, hitting its lowest level since July and missing forecasts of 50.5. The survey showed a drop in factory activity as output and new orders remained stagnant amid job cuts and low purchasing levels. However, business sentiment improved due to expectations of new government policies and expansion plans.

Markets also continue to assess the impact of new that top copper smelters in China will cut production by more than 10% in 2026 to counter overcapacity in the industry. Smelters in China have been facing negative processing fees due to extreme competion. The move follows comments by Chen Xuesen, Vice President of China’s Nonferrous Metal Industry association, who said last week that the state-backed association “firmly opposes any free and negative processing” of copper concentrate. However, skepticism in the markets remains has previous attempts to curb overcapacity in China have ultimately proved to be fruitless.

Zinc: Zinc lost 0.2% to $3,056.

Aluminum: Aluminum rose 0.6% to $2,882. Goldman Sachs on Wednesday said it sees LME aluminum prices to decline to $2,350 by end of year 2026.

Tin: Tin climbed 1.9% to $39,775.

Lead: Lead was up 0.4% at $2,002.

Nickel: Nickel advanced 0.5% to $14,870.

Precious Metals

Gold: Gold prices are higher as data from the ADP unexpectedly reflected a 32,000 drop in private payrolls in November, the third drop in four months, and one of the lowest readings since 2023. Yields and the dollar dropped following the release, offering further support for the yellow metal. The data also reflects calls from several FOMC members that interest rates should come down in order to support the labor market. Markets are also expecting a dovish tilt from the Fed in the longer-term as Kevin Hasset is expected to become the next head of the Fed when Powell’s term is over. At a White House event on Tuesday, President Trump dropped a major hint about the Fed chair role saying that a “potential” future chairman of the Fed was in the room, while Hassett stood close by. Markets are pricing just under a 90% chance that the Fed will lower rates next week. PCE figures for September on Friday could give markets further cues on the Fed’s policy path.

Silver: Silver futures are up 0.2% to $59.65.

Platinum: Platinum is little changed at $1,650.

Interested in more futures markets? Explore our Market Dashboards here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.