CORN

Prices were $.03-$.06 ½ higher in 2 sided trade. Spreads also firmed. Mch-26 finally broke out of its tight range since the USDA reports early last week. Resistance above the market near $4.40 where both the 50 and 100 day MA’s are converging. The year round sales of E-15 did not make the final bill in the US House yesterday. That could potentially have been a big long term boost for corn demand that has been capped at 5.50-5.60 bil. bu. for nearly a decade. The BAGE reports Argentine plantings have reached 93%, vs. 98% YA. They indicated we may see some acres in the north switch to soybeans. Export sales at 158 mil. bu. were well above expectations and the highest in 5 years. YTD commitments at 2.206 bil. bu. are up 34% from YA, vs. the USDA forecast of up 12%. Commitments represent 69% of the USDA forecast, above the historical average of 57%. There was 49 mil. Bu. sold to unknown, 33 mil. to Japan and 30 mil. to Korea. Pace analysis would suggest the already record USDA forecast at 3.2 bil. bu. is looking low.

SOYBEANS

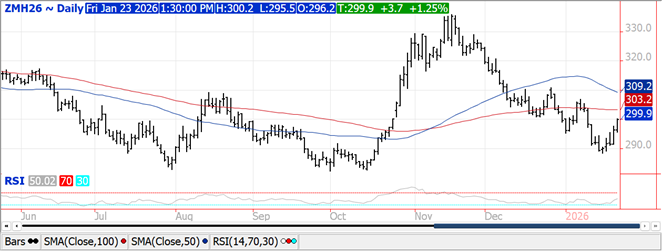

Prices were higher across the complex with beans up $.04-$.05, meal was $2-$4 higher while oil was up 20 points. Bean and oil spreads were mixed while meal spreads firmed. Spot board crush margins spiked another $.06 ½ to $1.86 per bu., a fresh 5 month high, while bean oil PV slipped back to 47.4%. An inside day for Mch-26 beans with next resistance at the 100 day MA at $10.82 ½. Mch-26 meal closed into new highs for the week with next resistance also at its 100 day MA at $303.20. Mch-26 oil jumped out to a 5 month high before settling back a touch. Next resistance is the July-25 high, just below $.57 lbs. The BAGE reports Argentine plantings have reached 96% while crop ratings fell 8% to 53% G/E, still above the 26% from YA. Export sales at 90 mil. while in line with expectations, they were a 2 year high. YTD commitments at 1.214 bil. are down 22% from YA vs. the USDA forecast of down 16%. Sales to China at 1.304 mmt (48 mil. bu.) bring total sales to 9.42k tons, coming closer to the 12 mmt they are believed to have purchased. China cancelled their new crop 26/27 purchase of 66k mt dropping those outstanding sales back to zero. Other noted old crop buyers were unknown – 12 mil., while Egypt and Mexico bought 7-8 mil. each. Meal sales at 413k tons brought YTD commitments to 9,806k tons up 11% YOY vs. the USDA forecast of up 5%. Bean oil commitments at 691 mil. down 53% YOY in line with the USDA forecast. Still waiting for SCOTUS to decide on the Trump Admin. use of tariffs. Final RVO’s and potential SRE reallocation from the EPA not expected to early March.

WHEAT

Prices ranged from $.01 to $.15 higher with KC and CGO the upside leaders. CGO Mch-26 traded to its highest level in a month, stalling just below its 100 day MA at $5.31. KC Mch-26 held below this month’s high at $5.44 ¾. Mch-26 MIAX closed just above its 50 day MA. This weekend’s winter storm will help ease drought readings in the SE plains. US winter wheat acres in drought increased 1% to 42% this past week hovering just below its 52 week high of 45%. Export sales at 23 mil. bu. were above expectations bringing YTD commitments to 768 mil. bu. up 18% from YA, vs. the USDA forecast of up 9%. Commitments represent 85% of the USDA forecast, above the historical average of up 80%. Perhaps we’ll see a bump up in Feb-26. Russia’s Ag. Ministry held their export tax at zero thru at least Feb. 3rd.

Charts provided by CQG

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.