CORN

Prices closed steady to $.02 lower with spreads also weakening. Mch-26 rejected trade above Friday’s before pulling back. Major resistance at $4.40 where both the 50 and 100 day MA’s are converging. Speculative traders bought 26k contracts on Friday reducing their net short position to 63k. OI jumped nearly 19k contracts. COF as of Jan. 1st at 97% of YA was in line with expectations. Placements at 95% were slightly above the 93% expected. AgRural raised their Brazilian production forecast .6 mmt to 136.6 mmt, vs. the USDA est. of 131 mmt. They est. the 1st crop harvest and 2nd crop plantings both at 5%. Export inspections at 59 mil. bu. were in line with expectations and just below the 61 mil. needed per week to reach the USDA forecast. YTD inspections are up 53% from YA vs. the USDA forecast of up 12%. Mexico took 15.5 mil. bu. while Japan took 10 mil. and Spain 8 mil. Record demand has kept corn prices from testing last summer’s lows while US ending stocks at a 9 year high of 2.2+ bil. bu. likely to keep price rallies in check.

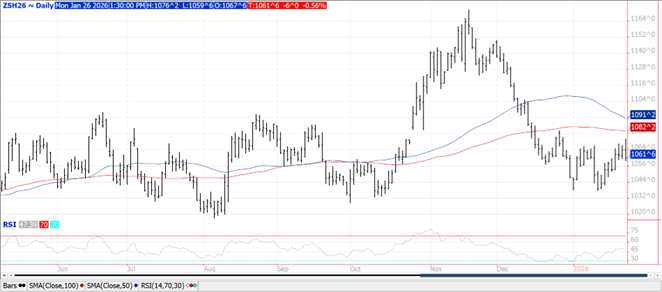

SOYBEANS

Prices finished lower across the complex with beans down $.03-$.06, meal was $3-$6 lower while oil was steady to 10 points lower. Spreads also eased across the complex. Mch-26 beans rejected trade above last week’s high. Next resistance is at the 100 day MA at $10.82 ¼. Outside day down for Mch-26 meal as it also rejecting trade above LW’s high. Initial support is at LW’s low of $288.40. Mch-26 oil jumped out to a fresh 5 month high before pulling back below $.54 lbs. A gap lower open in the US $$ fueled early gains. The dollar index fell to a fresh 4 month low as the Japanese yen surged on the rising risk of Govt. intervention to support the currency and counter market speculation. Better than expected rains in Argentina this weekend provided some needed relief while forecasts for week 2 of the outlook are trending wetter. Spot crush margins backed up $.07 ½ today to $1.78 ½ bu. while bean oil PV improved to 47.8%. AgRural raised their Brazilian production forecast .6 mmt to 181 mmt, vs. the USDA est. of 178 mmt. They est. harvest has reached 5%. Harvest in Mato Grosso, the top producing state, advanced 7% to 14% complete. Friday’s CFTC data showed MM’s were net buyers of nearly 28k contracts of oil, sellers of 21k contracts of meal and 3k contracts of soybeans. Soybean inspections at 49 mil. bu. were in line with expectations and above the 28 mil. bu. needed per week to reach the USDA forecast. YTD inspections at 759 mil. are down 37.5% from YA vs. the USDA forecast of down 13%. China took 33 mil. while Mexico took nearly 4 mil. With China now having purchased 12 mmt of US soybeans, look for US export demand to slow dramatically with SA offers running $.50-$.75 bu. below the US thru April-26.

WHEAT

Prices ranged from $.05-$.11 lower across the 3 classes with most contracts closing at or near session lows. Spreads also weakened. CGO Mch-26 appear to have had a short term breakout to the upside after rejecting trade above its 100 day MA. KC Mch-26 failed on a test of its January high of $5.44 ¾. Strength in Mch-26 MIAX was capped at its 100 day MA at $5.78. It will likely be weeks before we learn the extent of damage from the recent arctic blast in the central and N. plains. Our largest winter wheat producing state of Kansas likely avoided significant damage after receiving 2-3” of snow on Friday into Saturday, insulating their crop from the sub-zero temperatures over the weekend. The weekend storm will help ease drought conditions across much to the SE plain states and southern Midwest. Export inspections at 13 mil. bu. were at the low end of expectations and below the 16 mil. bu. needed per week to reach the USDA forecast. YTD inspections at 600 mil. bu. are up 18% from YA, vs. the USDA at up 9%. MM’s were net sellers of 4.5k contracts of CGO futures, nearly 1,400 in MIAX while only a couple hundred contracts in KC. Their combined short position across the 3 classes pushed on to a 2 ½ month high of 145,616 contracts.

Charts provided by CQG

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.