CORN

Prices were $.02-$.04 lower closing near the midpoint of the day’s range. Spreads recovered in late trade closing firmer. Mch-26 bounced after trading into new lows for the week at mid-session. Major MA resistance just below $4.40 with support at $4.17. The BAGE placed Argentine plantings at 97% complete. Crop ratings slipped to 46% G/E, well below the season high at 82% however better the 31% from YA. Speculative traders sold 2k contracts yesterday pulling their short position to 59k contracts while O.I. fell nearly 6k contracts. US exports remain strong, on pace to exceed the current USDA est. of 3.2 bil. bu. however more aggressive offers from Argentina may cut into US market share the 2nd half of the MY. Price likely to remain range bound between $4.15-$4.40 until more is known about SA crops.

SOYBEANS

Prices were lower across the complex with beans down $.08-$.10, meal was $3 lower while oil was off 50 points. Spreads firmed late with beans and meal slightly higher while oil spreads were unchanged. Mch-26 beans held support above this week’s low at $10.58 ½. Prices rejected trade above their 100 day MA the previous 2 sessions. Mch-26 meal and oil both slipped to new lows for the week before bouncing. The strong recovery in the US $$$ contributed to lower trade across the Ag. space today. Strength in the greenback was driven by Pres. Trump’s nominee to lead the US Federal Reserve along with higher than expected inflation data. The President selected former Fed Governor Kevin Warsh to head up the Central Bank. While Warsh has been critical of the Federal Reserve, he is viewed as a more hawkish selection compared to the other candidates. Spot crush margins slipped $.03 to $1.70 ½ while bean oil PV held steady at 47.7%. Census crush from Dec-25 after the close on Monday is expected to come in just above 230 mil. bu., which if realized would be the 2nd highest ever and up from 220.5 mil. in Nov-25. Oil stocks expected to jump 5% to 2.279 bil. lbs. Speculative traders were moderate sellers across the complex yesterday however O.I. was higher. Argentine crop ratings fell 6% to 47% G/E, still well above the 24% from YA. As global demands shifts back to cheaper offers in SA I lean toward another 20-30 mil. bu. cut to the current USDA export forecast of 1.575 in the Feb-26 WASDE. Rainfall distribution (or lack thereof ) across Argentina will likely be the key determinant in price action next week. As of this writing no data yet from the EPA on biodiesel & RD production, capacity and feedstock usage.

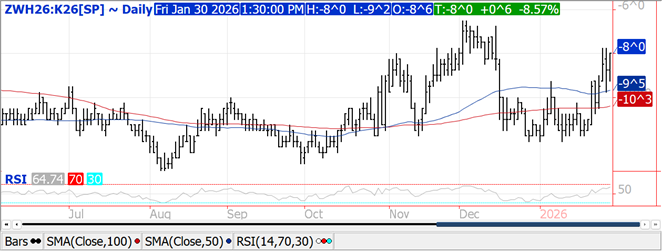

WHEAT

Prices were $.03-$.05 lower across the 3 classes closing near midrange. Both CGO and KC Mch-26 contracts traded to fresh 2–2 ½ month highs before backing up. Spreads firmed in late trade finishing slightly higher. Open interest in CGO rose just over 300 contracts yesterday as speculative traders were net buyers. O.I. fell nearly 4k in KC futures. US winter wheat area in drought fell only 1% LW to 41% despite the major winter storm. Little to no moisture for the S. plains over the next week. Moderate amounts for the S. Midwest and ECB. US export demand remains decent however not likely to exceed the current USDA est. by more than 10-20 mil. bu. The next monthly crop ratings will give better idea extent of damage to this year’s US winter crops from the recent frigid outbreak. Higher trade in wheat this week with everything around it lower would suggest some concern for the US winter crop. Cold temperatures in Russia not much of a threat with heavy blanket of snow, however could led to spring flooding.

Charts provided by CQG

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.