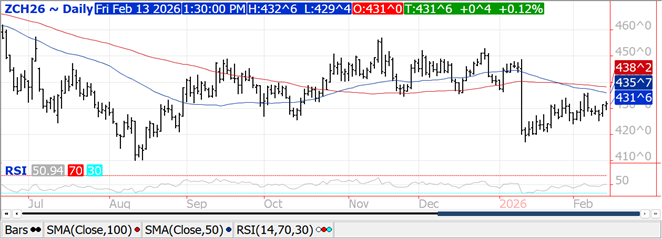

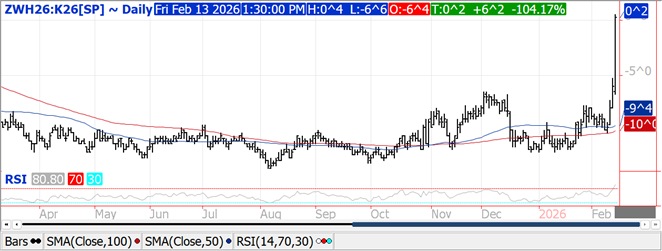

CORN

Prices were steady to $.01 higher while also little changed for the week. Spreads recovered a touch. Mch-26 traded to a new high for the week with next resistance at its 50 day MA which is also near LW’s high of $4.36. Spot prices remain rangebound between $4.15-$4.40. Export sales are running 31% over YA vs. this week’s revised USDA forecast of up 15.5%. The BAGE noted that recent rains across Argentina have been uneven with additional showers needed to support their production forecast of 57 mmt. Crop ratings fell another 1% to 43% G/E however remain well above YA at 26%. This week the USDA kept their Argentine forecast steady at 53 mmt. While Argentine FOB offers continue to run $.15-$.20 below US offers, Brazil remains largely absent as ethanol producers scoop up domestic supplies. Likely summer with the arrival of their 2nd crop before they are more active in the global marketplace.

SOYBEANS

A late recovery in meal enabled the soy complex to closed mixed. Beans were $.02-$.04 lower, meal was up $1 while oil was off 45 points. Mch-26 beans fell below yesterday’s low however recovered to still up $.18 bu. for the week. Mch-26 meal jumped out to a 7 week high Despite the pullback, Mch-26 oil was up $.0175 lb. for the week. Spot board crush margins improved $.02 to $1.75 bu. with bean oil PV slipping to 48%. Recent rains have brought some relief in EC growing areas of Argentina. While additional moisture is needed, forecasts continue to shift more favorable for the 2nd half of Feb. Much of NE Brazil was dry the past 24 hours however, localized heavy rains continued to impact Mato Grosso in the WC region. These rains stretched southeast into RGDS and Parana. Looking forward a dryer outlook across WC Brazil will favor crop maturation and harvest as heavier rains shift into the SC region. Soybeans will likely need to see additional Chinese demand soon to hold recent price strength. The BAGE held their Argentine production forecast unchanged 48.5 mmt while crop ratings fell another 8% to 32% G/E, still better than the 18% from YA. Look for a surge in the MM long soybean position in this afternoons CFTC COT data. IMEA reports that Mato Grosso’s soybean harvest barely budged last week holding at 51% due to widespread rains. That said, still above the YA pace of 43%. Brazilian FOB offers remain $.90-$1.20 below US Gulf thru May-26. NOPA crush on Tues. is expected to show NOPA members processed 218.5 mil. bu. of soybeans in Jan-26, down from 225 in Dec-25 however up from 200 mil. in Jan-25. Bean oil stocks are expected to have risen to 1.7 bil. lbs. up from 1.642 bil. in Dec-25.

WHEAT

Prices ranged from $.04-$.12 lower. Nearby spreads in CGO have spiked while mixed in C. CGO Mch/May closed at a slight inverse for the first time in 16 months. The current evaluation period for determining the VSR runs Dec. 19th thru Feb. 20th. So far the Mch/May spread in CGO has averaged $.10, just under 50% of full carry. Appears likely to hold under the 50% threshold which would trigger VSR falling to $.0016 per day starting Mch. 19th from the current $.0026. KC Mch/May has averaged nearly $.12 which would require the spread to narrow further to trigger a lower VSR. Export commitments are running 17% above YA, vs. USDA forecast of up 9%. IKAR raised Russia’s 2026/27 wheat production forecast 3 mmt to 91 mmt vs. the USDA est. of 89.5 mmt. The higher production forecast seems to have halted the recent price surge in its tracks following some reports their crop may have experienced damage from recent frigid conditions and icing issues. Russia held their export tax at zero.

Charts provided by CQG

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.