London Wheat Report

Prime Minister Rishi Sunak says the government will bring in a new law to “swiftly exonerate and compensate victims” of the Post Office scandal. UK and US naval forces have repelled the largest attack yet by Yemen’s Houthi rebels on Red Sea shipping, UK Defence Secretary Grant Shapps says Carrier-based jets and warships shot down 21 drones and missiles launched by the Iran-backed group overnight.

Argentina’s core farming heartland will receive little or no rain over the next few days, which will help the progress of soybean and corn planting, the Buenos Aires grains exchange said on Wednesday.

Ukraine exported 4.8 million metric tons of food via its Black Sea corridor in December, surpassing the maximum monthly volume exported under a previous United Nations brokered grain deal, brokers said on Wednesday.

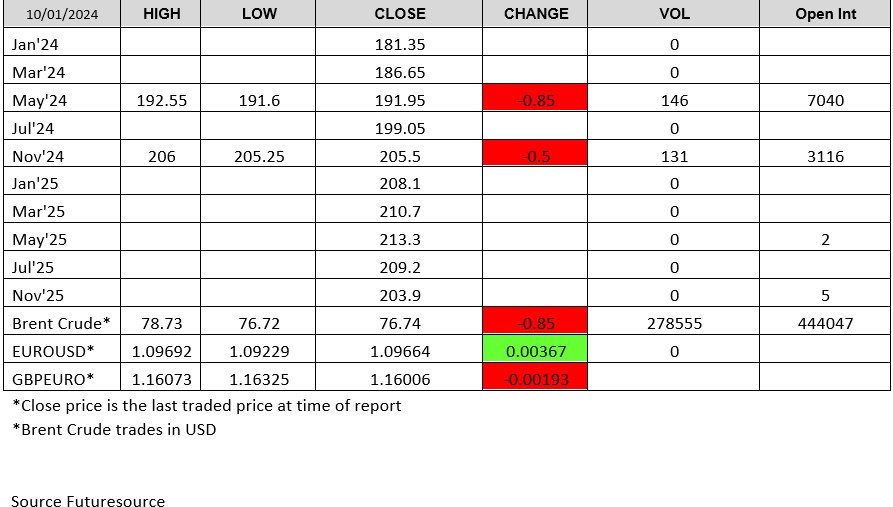

US markets were a little more subdued today than the rest of the week, no double digit gains or losses which in these volatile markets which we’ve seen of late, could be music to some people’s ears. Beans were slightly off, only 3 cents. Meal was also down, while oil had a slight jump. Corn was effectively flat after yesterday’s gains. Chicago wheat stayed level whilst Kansas and Minap wheat were down and up two cents, respectively.

Matif Rape saw its second day in the green after a number of days on the slide, ending the day up around 3 euros. European wheat markets were mixed in today’s trading. Matif wheat was slightly up whilst London was slightly down. Matif March was up 2 euros. Old and new crop London were both down. May came off further than Nov which left the spread trading wider again, now around the £13.75 mark. Volume was evenly spread over the two expiries and stood around 300 lots across the curve.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.