London Wheat Report

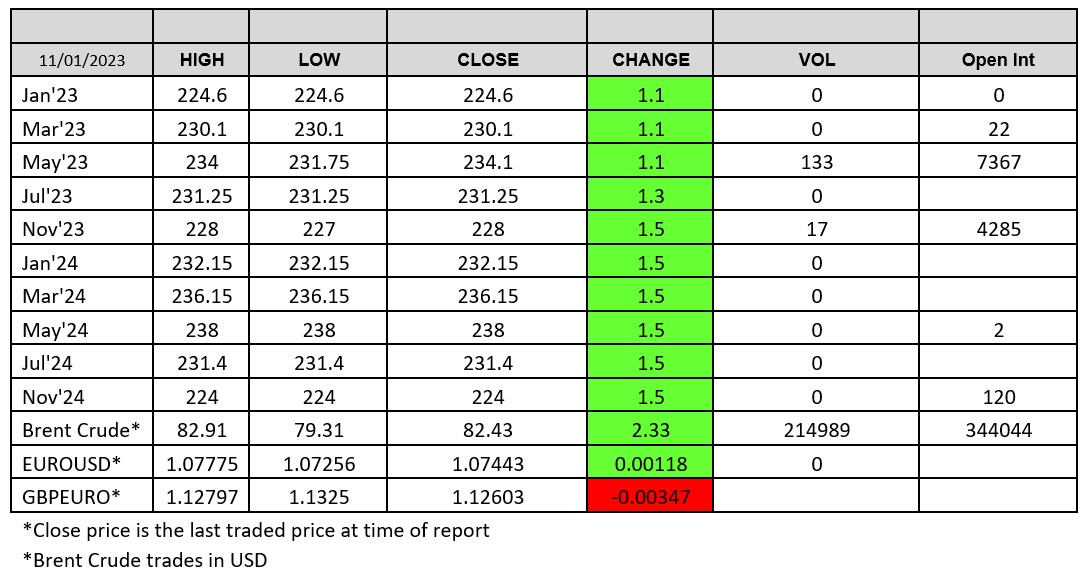

Source: FutureSource

All eyes on tomorrow’s USDA supply and demand report, could bearish news drive US wheat into the 600s? Chicago wheat has been trading down at 15 month lows, any more bearish news and US wheat may start to look competitive. Today Chicago saw a little support and Mar-23 was trading up 8 cents a bushel at the time of writing.

Argentina is making headlines once again today, the Bdec Buenos Aires Grain Exchange said FINALLY its drought that has caused a catastrophic hit to countries wheat production could be coming to an end, however, it could take until march for rain and soil moisture levels to return to normal. Argentine farming has been strained for three years in a row by the La Nina weather phenomenon, which for the 2022/23 season caused a particularly painful drop in rainfall. As a result, the exchange expects the 2022/23 wheat harvest to reach just 12.4 million tonnes, down from the 22.4 million tonnes harvested the prior year.

There isn’t much bullish news in the European wheat markets. European crop is said to be in a very good condition, and although some exposed wheat in the Ukraine/ Russia Black Sea area is said to be suffering from the extreme cold, this isn’t offering much, if any support to the bearish sentiment.

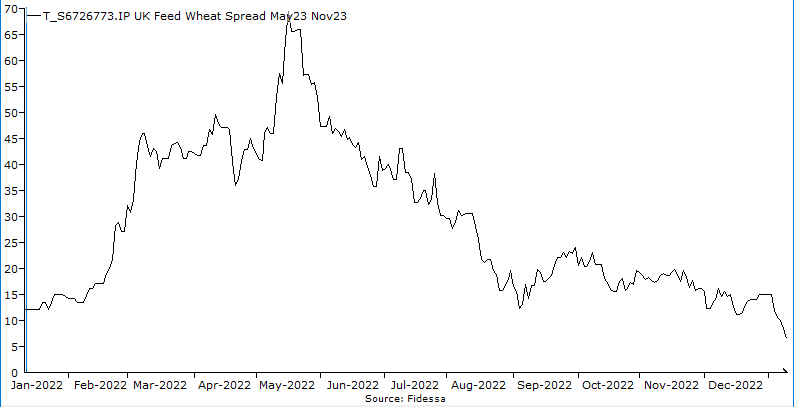

The London wheat May 23/Nov 23 spread has seen a steady fall over the past 7 months. Who remembers the dizzy heights of May last year? Below illustrates how in May last year the spread was trading at a whopping £69.50 premium, this has fallen to trading around the £6 today. It is worth noting that at the same time the spread was trading at £69.5, the May outright was trading over £100 more than it is today @ over £350 /tonne.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.