London Wheat Report

About 4% of winter cereals in Russia are in “poor and sparse” condition, the Russian Grain Union said on Monday, compared to a typical rate of 6% at this stage of the season. The overall state of the crop is not a cause for concern, the association said. Its head, Arkady Zlochevsky, said grain exports in the current 2023/24 season could reach 70 million tons if the Russian government increases the quota by 4 million tonnes.

Canadian farmers will plant 3% less canola and the same area of wheat as last year, government agency Statistics Canada reported on Monday. Unsurprisingly this lent support to Canola today, trading up double figures at the time of writing.

Brazil’s soybean harvest for the 2023/24 cycle had reached 55% of the planted area as of last Thursday, agribusiness consultancy AgRural said on Monday. The pace of harvesting slowed down, growing 7 percentage points from the previous week, as the harvest is now more concentrated in areas that were planted late. The figure was also above the 53% seen at the same time a year earlier.

Russian wheat export prices fell last week on continuing high supply in the world market, but analysts forecast significant growth in shipments from Russia in March. The price of 12.5% protein Russian wheat scheduled for free-on-board (FOB) delivery in April was $198 a metric ton, down $5 from the previous week.

USDA said ‘China cancels 264,000 tons of SRW Wheat in 2023-24’. This is the third cancellation in the past week. Cumulative cancellations to China since last Thurs. is now nearly 19 mil. bu. reducing total outstanding sales to 30 mil. of SRW.

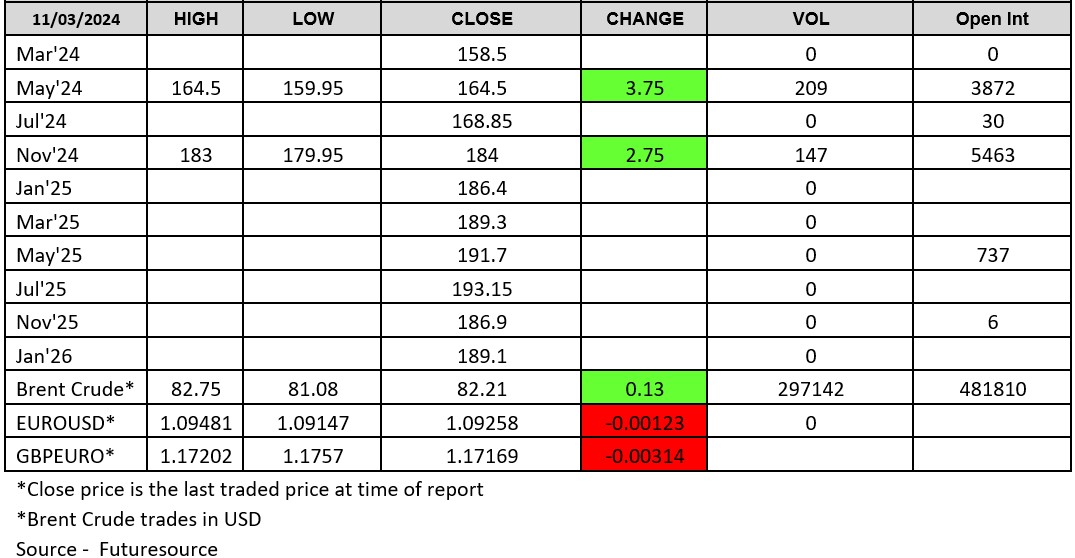

Global wheat markets had a turnaround in today’s trading. The morning saw the screen trading red but the markets all turned round to post large gains on the close, or at the time of writing. Chicago wheat was trading into double digit gains, Minap and Kansas also posting single digit gains. Matif was well supported across the curve and London saw its largest gains in some time. Nothing we could see was to blame for the moves, perhaps ‘’short covering’’ will be to blame.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Ryan Easterbrook or Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.