London Wheat Report

Source: FutureSource

WASDE day tomorrow with traders getting into position even though there is minimal for the bulls to crank on. Still plenty of chatter over the US debt ceiling but very little action going on. Stock market and crude is down today. Grain corridor chat continues with the usual rumours that the talks are not going well and they are continuing at a ‘technical level’. BOE increase base rate to 4.5%.

Wheat markets were pretty sluggish yet again today. Algeria bought a reported 500k-600k tonnes of milling wheat yesterday at a reported 275/277 per T C&F, all Russian Black Sea believed. Russian exporters appear to have their new bottom line at $260/t from Vladdy. US weekly wheat net sales hit a marketing year low at 26,300t. Rouen’s wheat exports remain slow, down 28% W-O-W. Tomorrow’s WASDE report will be an insight into what new crop US has lost. Russian spring planting is cruising ahead, having sown 3.5Mha of wheat which is 2.7 times higher than last year according to SovEcon. Favourable weather conditions and warm temperatures are allowing it to seriously fire up.

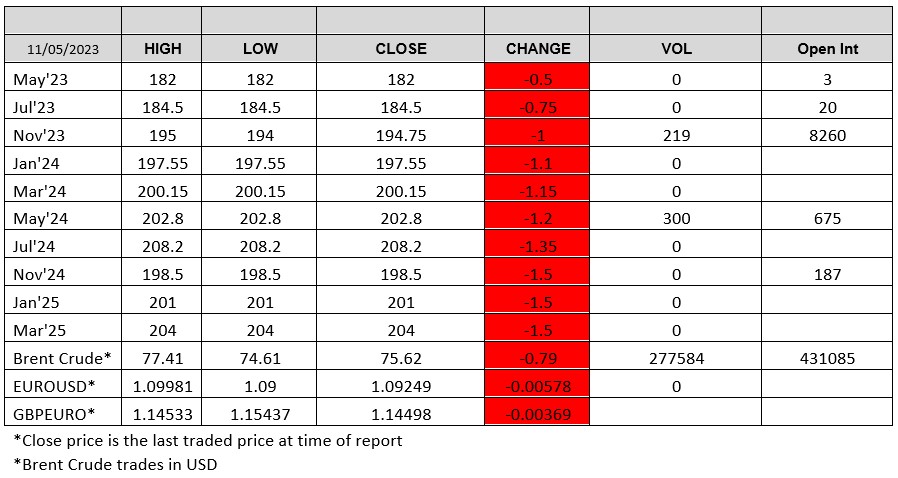

Chicago wheat was off today. Matif Sep-23 was trading just off for most of the day before settling down 0.25 on yesterday at €232/t. Volumes were average. London wheat had a steady day with only 219 lots traded, we didn’t really move very far price wise at all.

US corn markets were still bearish with weekly net sales still down. Weather conditions remain favourable in both the US and Brazil. Oilseed complex was off today in both the US and Europe.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.