London Wheat Report

Many thousands take to the streets in Yemen’s capital hours after the US and UK hit Houthi positions in overnight strikes. Winds from the Arctic will bring some very cold weather early next week. There will be some widespread frosts with temperatures as low as -10C (14F) in rural parts of the UK. BBC Radio 1 DJ Annie Nightingale, the station’s first female presenter, who went on to become its longest-serving host, has died at the age of 83.

A recent cold snap in France and Germany is likely to have caused limited damage to waterlogged grain fields, with heavy showers that further delayed sowings ahead of this year’s harvests of greater concern, analysts said. Since mid-December, there has been no significant progress in sowings, which means there will be a large carry over to spring grains such as spring barley, maize and sunseed. It is thought the fall in winter grain area could be more than 500,000 hectares.

Brazil’s 2023/2024 soybean crop will total 143.18 million metric tons, 7.5 million tons below a previous forecast of 150.7 million tons of production, according to a new report by Patria Agronegocios on Thursday. Brazil’s total corn crop will reach 110.29 million tons, down from the 112.51 million tons in a previous forecast, Patria said, citing climate risk.

China’s agriculture ministry raised corn production forecast but lowered its estimates for soybean output in the 2023/24 crop year in its January outlook released on Friday. Corn production is forecast at 288.84 million metric tons, slightly higher than its previous forecast of 288.23 million tons due to a larger estimated planting size.

WASDE report day. A Bearish one! SH down 25, CH down 11 WH down 11 cents.

The global wheat outlook for 2023/24 is for larger supplies, consumption, trade, and ending stocks compared with last month. Global supplies are raised 3.6 million tons to 1,056.5 million on higher beginning stocks and production.

Global 2023/24 soybean production is raised 0.1 million tons to 399.0 million as higher production forecasts for Argentina, the United States, Russia, China, Paraguay, and Bolivia are offset by lower Brazil production. Abundant early-season rainfall improved yield prospects for Argentina and Paraguay, raising production 2.0 million tons to 50.0 million and 0.3 million tons to 10.3 million, respectively. China’s soybean crop is increased 0.3 million tons to 20.8 million on reports from China’s National Bureau of Statistics.

Global coarse grain production for 2023/24 is forecast up 11.9 million tons to 1,513.9 million. This month’s foreign coarse grain outlook is for larger production, lower trade, and higher stocks. Foreign corn production is forecast higher with increases for China, India, and Paraguay partly offset by a decline for Brazil. China corn production is raised to a record 288.8 million tons based on the latest area and yield data from the National Bureau of Statistics. India corn production is raised on higher area. Brazil corn production is cut reflecting lower second crop corn area expectations.

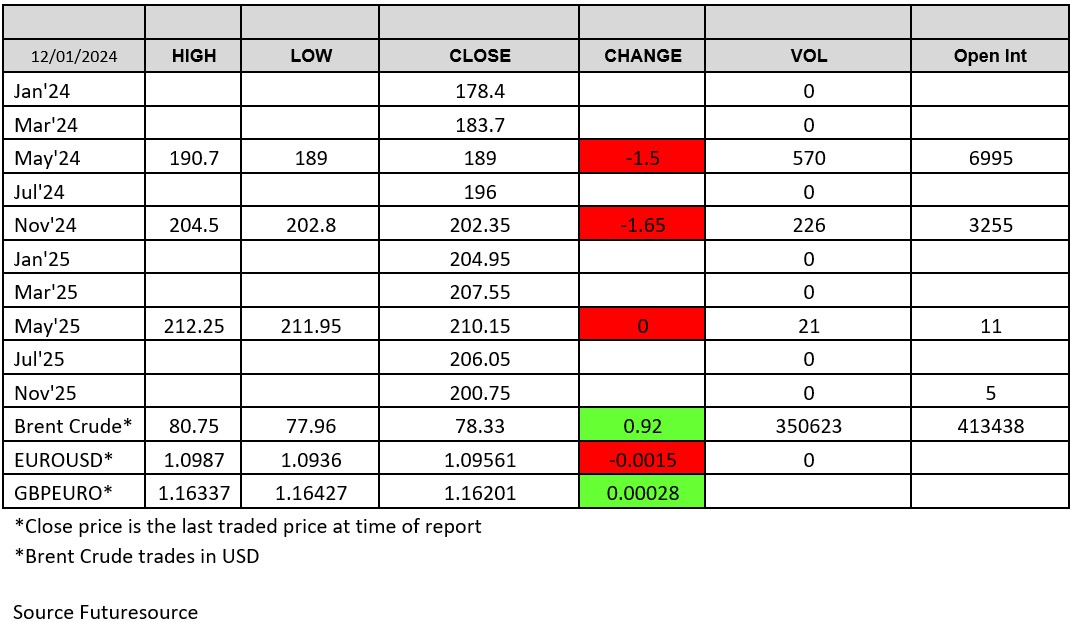

London May4 broke into the 180s today, the majority of the day London was trading pretty much unchanged until the WASDE report at 5pm London saw a flurry of trades going through under the 190 mark. Volume was pretty strong, a 300 lot May 24 AA went through first thing @ 191 to kick us off, and on screen volume across the curve was 4 short of 500. So a strong 800 lot day to end the week. Nov and London both traded down around £1.50 at the end of the day keeping the spread pretty much unchanged going into the weekend.

Good weekends all.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.