London Wheat Report

Source: FutureSource

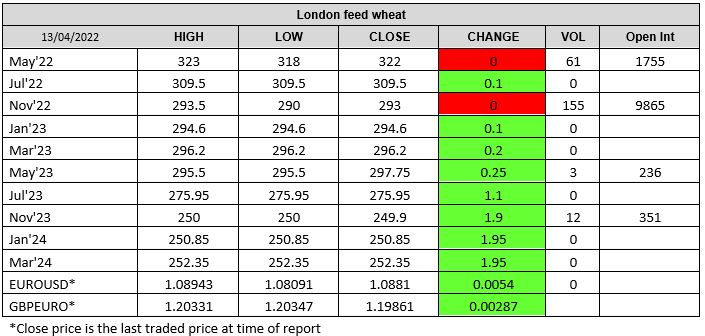

Markets were seen position squaring today ahead of the Easter weekend. US markets were mixed with wheat finding some support in the afternoon session. Global markets are optimistic that China’s draconian lockdowns are getting closer to ending. Weather for the southern plains offers some precipitation. Snowfall in areas of the states is also adding additional moisture benefit. Chicago May-22 wheat was trading up 6 cents at time of writing.

Ukraine/Russia no major news. Egypt’s GASC announced the purchase of 350kt of European wheat in its tender. A total of 8 EU offers on FOB terms and one Russian offer on C&F terms. Delivered to Egypt, European offers are $20 – $30 higher than the Russian one. Cheapest EU offer is $40 higher than the March 1st tender (which was cancelled). Japan’s MAFF is in for 115kt of milling wheat and rumours are appearing that Algeria bought 50kt of milling wheat overnight at around $460/t C&F. Matif May-22 settled up €3.75 on yesterday at €4.00/t and Sept-22 settled down €0.25 on yesterday at €370/t. UK 2022 wheat area is anticipated to be higher than last year with 81% of the UK wheat crop in the ground in good/excellent condition. The May-Nov 22 London wheat spread stands at £29/t, only just over a month ago it stood at a substantial £54/t.

Ukraine 2022/23 rapeseed production has been reduced to circa 2.6Mmt, 18% down from the previous update due to the ongoing issues with the war and supply chains that are affected by this. Harvested area has been reduced to 1Mha, down 10% from previous estimates and average yield has been pitched toward 2.6t/ha, again a 10% decrease from initial outlook as discussed by Reuters. China’s COVID issue has also seen their soybean imports reduce in March-22 to 6.35Mmt vs 7.77Mmt the previous year. Malaysian palm oil pushed higher. Matif May-22 rapeseed settled up 75c at €991/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.