London Wheat Report

Source: FutureSource

Well, the fallout from the SVB bank collapse continued on the markets today with the announcement that HSBC have purchased the UK arm of the bank for a token £1.00. President Biden was making an announcement to calm the markets earlier this morning with the US Treasury announcing that they are going to make $19 trillion available to guarantee all bank deposits rather than the standard $250k limit. Brent crude lost around 5% in this morning’s trade before firming up in the latter half of the afternoon, hitting trading lows of $72.3/ba – lowest level seen since December 2022.

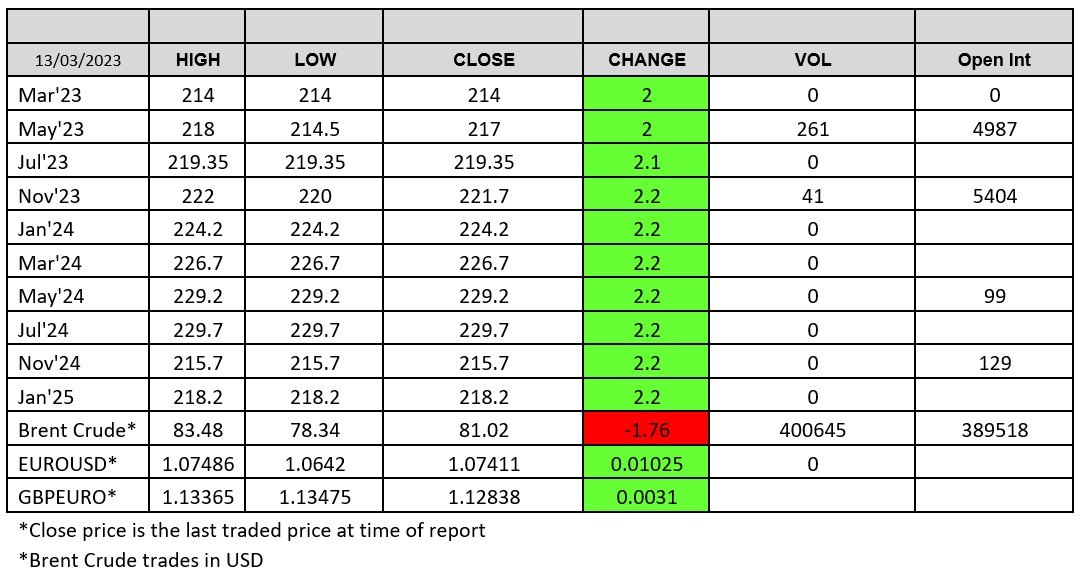

Wheat markets had a turnaround today with Chicago leading the charge in this morning’s trading which saw Chicago wheat trading up 15/16 cents before pulling back and trading around 8 cents above Friday’s close as a weaker USD and funds trying to flatten positions following the banking issues started buying back short positions. Matif was trading up a Euro this morning before it followed Chicago higher with May-23 settling up €4.75 on Friday at €263/t. Traded volumes were on fire on Matif wheat today after quite a sluggish week last week with 57,219 lots traded on May. London was pretty mundane with limited volumes trading, supported by Matif.

Saudi GFSA secured 1.043Mmt of wheat in its latest tender with a reported price of $316.86/t CFR. Algeria have also hit the market for 50kt of wheat. US weekly wheat inspections were under estimates, coming in at 249,017t. Russia’s final grain crop has come in at 157.7Mmt with 104.2Mmt of wheat according to Rosstat.

Private estimates continue to cut down the Agry corn and bean crop following last week’s WASDE report. Trade is now firmly of the belief that beans will be coming in below 30Mmt and corn will be sitting around the 34/35Mmt mark according to the market. Chicago beans were trading lower today as export inspections were below expectations at 618,803t. Brazilian soybean production is pegged at 94Mmt in 2023 according to Safras & Mercado, miles above last year’s 78.7Mmt.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.