London Wheat Report

Source: FutureSource

Well, the global bank stock rout deepens as SVB collapse fans contagion fears. Market sees FED raising rates by 25bps next week and in May. Meta are announcing further layoffs equating to 10,000 job losses in the second set of layoffs. Funds continue to liquidate positions in search of capital, especially the specs.

Primary news on the markets today was the unsurprising extension of the Black Sea corridor for 60 days according to Russia or 120 days according to the Ukrainians – either way, it’s going to be staying open and shipments will continue to roll through without an issue which is certainly unsurprising. Global wheat remains cheap and this can be seen as the larger buyers are hitting the market once again. Algeria booked at least 540kt of wheat for May delivery on the back of a 60kt tender and Tunisia also joined the party booking 234kt for Mar-May delivery. Japan have also hit the market or 75kt of wheat, most probably North American origin.

Chicago had some further support today on the back of funds liquidating positions to raise capital to shore up their bank balances. Chicago May was trading up 12 cents at time of writing. Matif wheat also found some support, pushing higher. London wheat kicked up towards the end of the trading day.

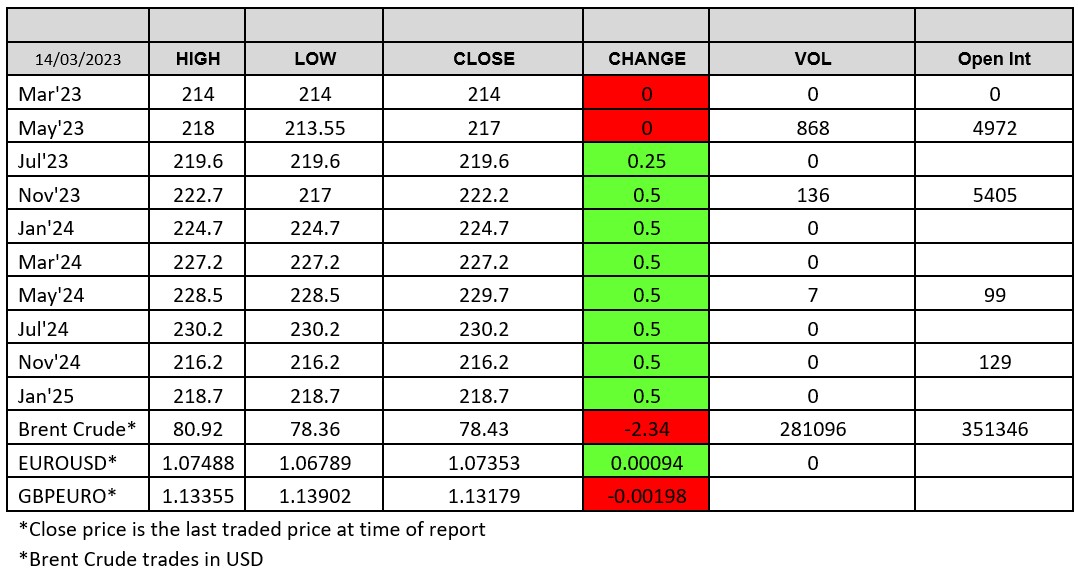

USDA reported 612kt of corn was sold to China. Brazil exported 4Mmt of soybeans in the first two weeks of March according to customs data. Brent crude was trading down 2.53% at time of writing at $72.87/ba.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.