London Wheat Report

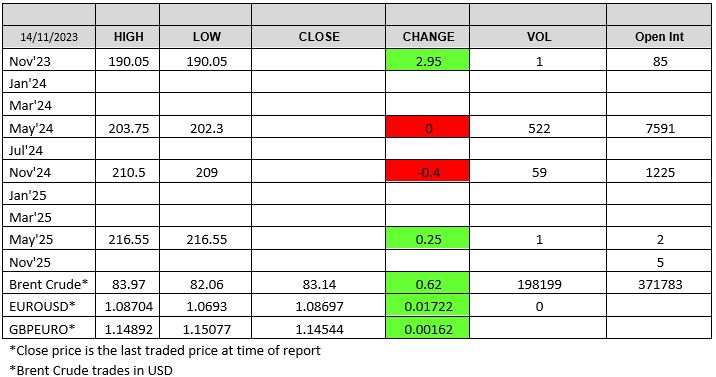

The latest US CPI report showed consumer prices in October were unchanged from the previous month and up 3.2% from a year ago. Stock futures rose shortly after the report. The betting now from the market is no more rate rises and May 24 will be the start of rate reductions. Zelenskiy announced today that exports through the new ‘’black sea corridor’’ have reached 4M metric tonnes of grain since it began in August after the official grain corridor ceased. Declaring “The grain corridor is working. We are now overcoming the four million tons mark and maintaining positive dynamics,” Zelenskiy said. Furthermore, Ukraine and Britain have agreed a special mechanism for discounts on war risk insurance for Ukrainian goods exports, including through the Black Sea corridor, the Ukrainian Prime Minister said on Tuesday. “It will make it possible to make a discount on the cost of insurance against military risks for exporters of all products from Ukraine. This will make the Black Sea corridor more accessible to a wider range of exporters,” Denys Shmyhal said on Telegram messenger. Germanys winter Rape planting areas for the 2024 harvest are expected to be reduced between 4% and 7% against the area harvested in summer of 2023, to between 1.09 to 1.13 million hectares, German oilseeds industry association UFOP estimated on Tuesday. Challenging weather as well as reduced prices over the past year made it less attractive for farmers to grow Oilseed Rape. The U.S. Department of Agriculture (USDA) on Monday rated 47% of the U.S. winter wheat crop in good-to-excellent condition, down three percentage points from the previous week but still the highest for this time of year since 2019. The USDA rated 31% of the Kansas wheat as good to excellent, unchanged from last week. The share of U.S. winter wheat production located in a drought area stood at 42% as of Nov. 7, unchanged from the previous week but down significantly from 74% a year earlier. Soybeans and Corn gave back some of their gains from yesterday in the early session today, but were back up at the time of writing just before the European closes. Soybeans settled well up yesterday, as did Corn. US COT was released a day later than usual and showed aggressive bean buying, in total 45K lots last week, MM also went shorter of 25K lots of Corn taking their position to SHORT 168,588 lots. Mixed day on the European wheat markets. Up, down and sideways. Matif was yoyo-ing in and around yesterday settlement for most of the day, before closing down. London was supported, the main May 24 contract traded over 500 times and was up for most of the day finishing slightly stronget @ 202.50. Nov 24 was less liquid but traded down in the AM before finding support in the PM before trading negatively on the close. Nov 23 hasn’t got long left, a week in fact and traded once for £190.05 up £2.95. A rogue 1 lot of May 25 went through at £216.55. |

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.