London Wheat Report

Source: FutureSource

Happy Monday. Turkish elections are in full swing with Erdogan appearing to have a larger margin than originally estimated with the initial results showing him leading with 49.51% of the vote with his main challenger sitting on 44.88%. Runoff vote has been confirmed by the supreme election council. Egypt appears to have brokered a cease fire between Israel and Palestine over the weekend as things got a little heavy. Bakhmut action continues. Extinction rebellion were causing some mischief at the National Conservatism conference. Optimism in a debt ceiling agreement rises.

Well, markets were digesting Friday’s WASDE report and wheat markets continued to find support again today as weather trading continues and the demise of the HRW crop continues. There has been some chatter about the extent the USDA reduced the HRW crop in their report but the crop tour this week with boots on the ground should ascertain this further. Rains were seen across the Southern plains over the weekend but late in reality for any major change or benefit to the current crop in the ground really. Export prices for Russian wheat continue to decline on sluggish demand, complete opposite to the markets following on from Friday so expect them to subside once the bullish trade has calmed down. Algerian tender was filled with Russian wheat offered at $245/t and export prices for June are hovering around the $248/t mark according to IKAR, down $6/t from last week. Demand is sluggish and minimal excitement in the market. Russian wheat exports for May are estimated at 3.8Mmt according to SovEcon, down from the 4.3Mmt seen in April. Canadian crop planting is behind in Saskatchewan.

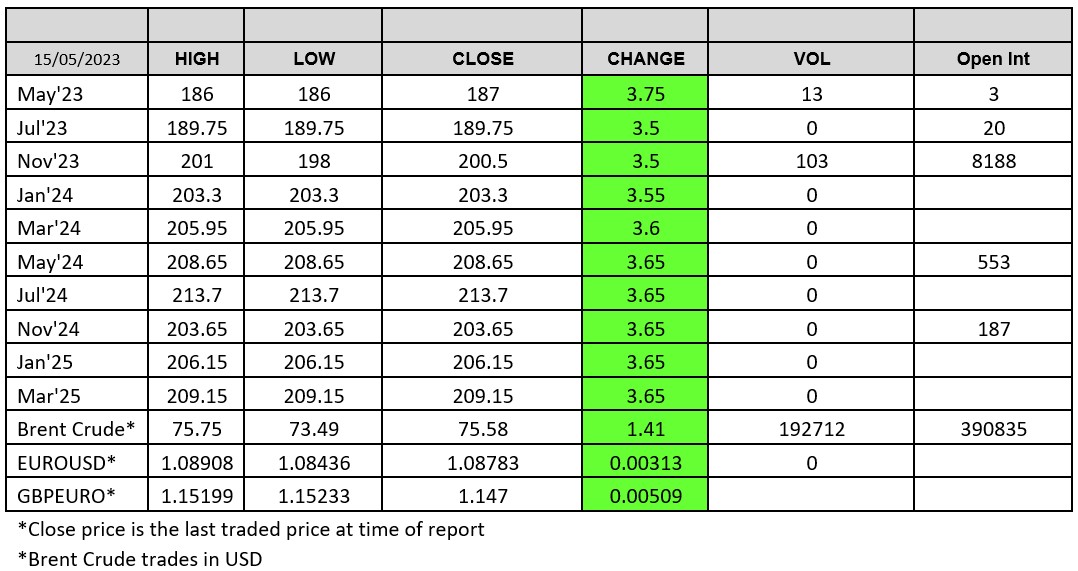

Screen of green today for a change. Chicago wheat continued to find support in today’s trading, carrying on the firm tone from Friday’s report. Matif was also supported today, again helped by strong Chicago trade and the market has been waiting for some bull support for a while although the fundamentals remain unchanged in reality and Black Sea wheat is being thrown out the door cheap cheap. Matif wheat Sep-23 settled up €4.75 on Friday at €239.50/t. London wheat also found support on the back of the with Nov-23 hitting the £200/t levels.

USDA announced the sale of 100kt of soybean meal to Poland. Brazilian bean values are starting to tick up with questions being asked regarding the Argentine crushers’ ability to secure enough supply. US soybean inspections were down 62.8% at 147,897t according to the USDA. Matif rapeseed found support today with Aug-23 settling up €7.25 on yesterday at €423.25/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.