London Wheat Report

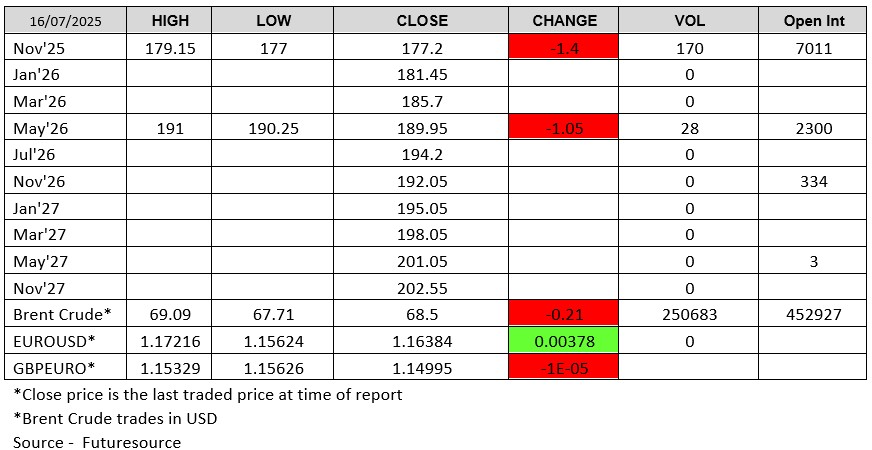

The theme continues this week with yet another day of sluggish volumes through all traded London wheat futures contracts. This perhaps indicates that the underlying market is somewhat preoccupied with combines rolling through fields across the country, resulting in farmers focusing on getting it into the shed rather than selling the grain out of it. Matif wheat also saw a slower day, trading around half the amount usually seen across screens.

In France, the farm office FranceAgriMer today released a forecast indicating that stocks of the main French wheat crop will swell to a 21-year high in 2025/26 as a rebound in production outweighs an expected doubling in exports outside the EU. France’s wheat harvest is reportedly progressing well, especially when compared to last year’s dismal effort. There are some that are cautious about French export prospects given stiff competition from global wheat producers and ongoing diplomatic tensions with major importer Algeria. FranceAgriMer projected soft wheat stocks at 3.87 million tonnes, up 66% compared with 2024/25 and the highest level since 2004/05.

From the other side of the world, it has been reported that Canberra is close to an agreement with Beijing that would allow Australian suppliers to ship five trial canola cargoes to China. China, the world’s largest canola importer, sources nearly all of its imports from Canada, but those supplies could be limited by an anti-dumping probe Beijing is conducting, thus leading Beijing to scour the globe for a replacement. It stands to be a potentially highly lucrative deal for the Aussies, as China has bought an average of 4 mmt of canola, worth over USD 2 billion, each year for the last five years.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Ryan Easterbrook, Aaron Stockley-Isted and Jamie Kirkwood

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.