London Wheat Report

Source: FutureSource

With this morning’s news that the last ship left Ukraine today under the current grain corridor deal which ends tomorrow and no extension had been agreed, surely the global wheat markets rallied? London up £15 and Matif 20 Euros?… NO. Global wheat markets took no notice of the unrenewed grain deal and were in the red in the AM. Much of the same news (bar the grain corridor chat) left the markets continuing in the downward motion seen of late. Later in the day, Turkey confirmed the grain deal had been agreed for a further 2 months, the markets saw further loses. Erdogan said “The Black Sea grain corridor deal has been extended by two months with the efforts of Turkey,” he said in his televised speech, also thanked the Russian and Ukrainian leaders and U.N. Secretary General Antonio Guterres for their help.

Ukraine, a traditional grower of winter wheat, is likely to sow a record 285,000 hectares of spring wheat in 2023, the Ukrainian agriculture ministry said on Wednesday. Farmers have already sown 247,000 hectares of the commodity, it said in a statement. The ministry gave no comparative data for 2022 but said that Ukraine sowed 160,200 hectares of spring wheat in 2021.

Reuters reported today, Farm office FranceAgriMer on Wednesday lowered its forecast of French soft wheat exports outside the European Union in the 2022/23 season to 10.30 million tonnes from 10.40 million projected in April. In a monthly supply and demand outlook for major cereal crops, the office also trimmed its forecast of 2022/23 French soft wheat exports within the 27-member bloc to 6.39 million tonnes from 6.43 million previously. It increased its projection of French soft wheat stocks at the end of the season on June 30 to 2.72 million tonnes from 2.61 million projected last month.

Special mention for Rapeseed Aug which broke into the 300’s this afternoon. Rapeseed has been aggressively sold off recently and breaking below 400 was another big step. Aug23 traded down as low as 392.75 on today’s session.

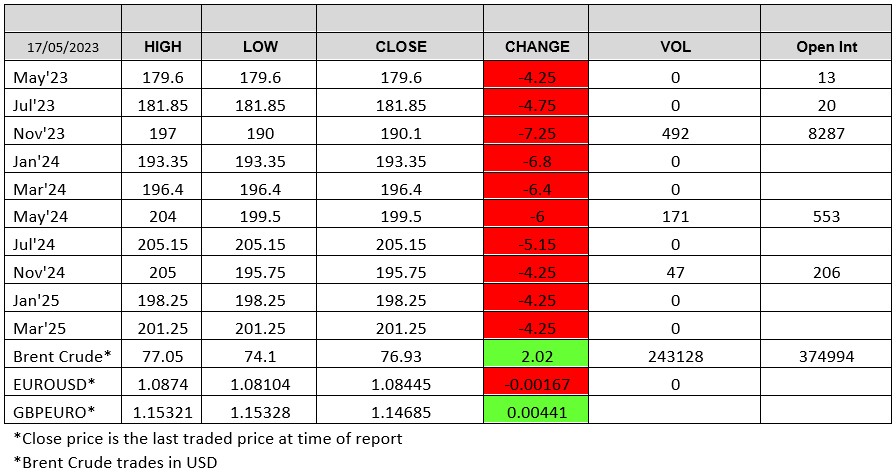

London had a quiet start and didn’t really take off until lunchtime. Nov 23 traded down all day, with the HOD 35p under yesterday’s sett. Volumes were not too bad with 492 crossing the line between 197 and 190. £190 LOD is a huge £7.35 down on ydays Sett. £166.30 is the November 23 contract low, can we get there? May 24 traded down all day between £204 and £199.50. One thing to bear in mind is London wheat is boarding on the ‘’oversold’’ territory with an RSI of 32.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.