London Wheat Report

Happy Monday and Christmas week!!

Oil giant BP has announced it is pausing all shipments of oil through the Red Sea after recent attacks on vessels by Houthi rebels. Crude shot up. Hamas health officials say at least 110 Palestinians have been killed in Israeli airstrikes in Jabalia in northern Gaza.

Money Managers in the US trimmed their net short position in this week’s COT report. As well as this, they also trimmed their net short in CBOT wheat. Both the Corn and Wheat positions are amongst the largest in history. MM also cut their net long position in Soybean.

Russian wheat export prices rose again for the 5th week in a row as unfavourable weather and demand from importers raised carry costs. The price of 12.5% protein Russian wheat scheduled for free-on-board (FOB) delivery in January was $242 per metric ton, up $1 from the previous week.

China logged record corn imports of 3.59 million metric tons in November, customs data showed on Monday, adding to a record domestic crop and further pressuring prices in the world’s no.2 grower. November corn imports surged 384% from a year ago, coinciding with a record domestic corn production of 288.84 million tons this year, following a government push to raise the output of the staple grains for food security purposes.

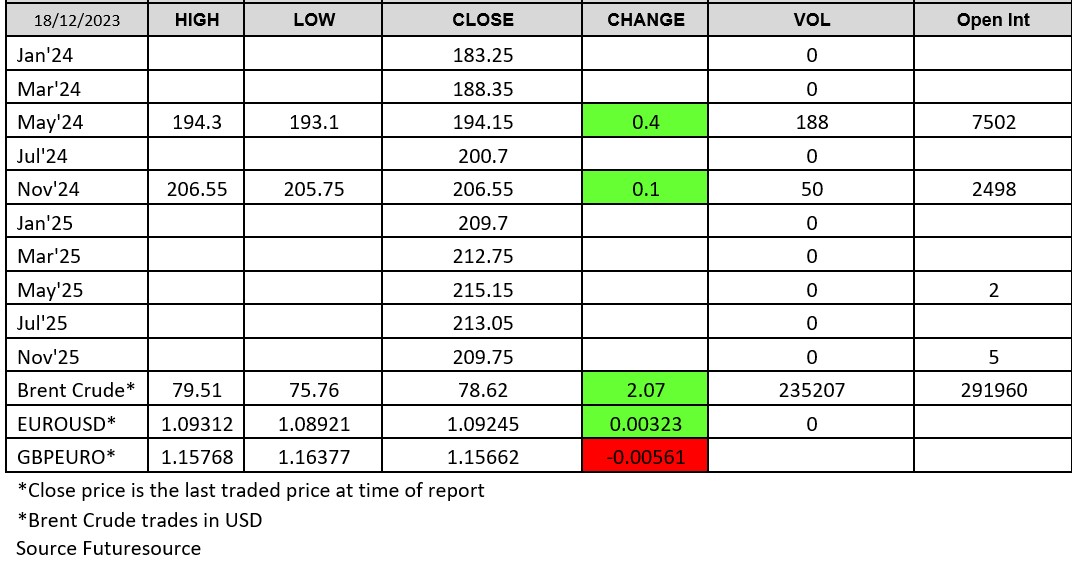

London had a busier day than most expected. Over 200 lots were traded across the curve on screen. The price flirted in and around Fridays settling, eventually closing slightly up. May 24 traded up to a high of £194.30 up 40p and Nov 24 traded up to £206.55.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.