London Wheat Report

Prime Minister Rishi Sunak has said the government is now able to cut taxes, after the pace of price rises eased. A Royal Navy nuclear submarine suffered a “concerning” malfunction while diving. Australia beat India in the cricket and Colombian pop star Shakira has reached a deal with Spanish prosecutors to settle a tax fraud case, The singer has paid a €7.5m (£6.5m) fine – prosecutors had wanted to jail her for eight years and fine her €23.8m (£20.8m) if found guilty.

Javier Milei’s election as Argentine president offers an opportunity for “radical change” in policy for the grains sector, the country’s main rural associations said late on Sunday, offering to work “side by side” with the libertarian. Argentina is one of the world’s top exporters of soy, corn, wheat and beef. However, its grains and livestock producers have been asking for the elimination of taxes and caps that they blame for crimping grain and meat exports for years. Milei is also looking to Dollarize Argentina’s currency. Whether this will happen, we will wait and see.

Soybeans and Corn have been well supported recently on the back of weather stories in South America and today’s CFTC COT report shows that money managers also supported the market. MM extended their net long in CBOT soybean futures and options to an 11-week high of 87,913 contracts from 68,598 a week earlier. Funds added more than 80,000 contracts to their net long in the three weeks ended Nov. 14, their biggest three-week soy buying spree since June. CBOT January soybean futures SF24 rose almost 6% during that period, including 2% in the latest week. Money managers through Nov. 14 expanded their net long in CBOT soybean meal futures and options to 131,404 contracts from 111,987 a week earlier, also on new longs. Money managers cut their net short in CBOT corn futures and options by about 5,100 contracts to 163,486 through Nov. 14, their most bearish stance for the date since 2017.

Ukraine can potentially harvest 18 to 20 million metric tons of winter wheat in 2024 after farmers sowed around 4 million hectares (9.9 million acres) of the crop, a senior farm ministry official said. Ukraine is expected to harvest 79 million metric tons of grain and oilseed in 2023, with a 2023/24 exportable surplus of about 50 million tons, the ministry has said.

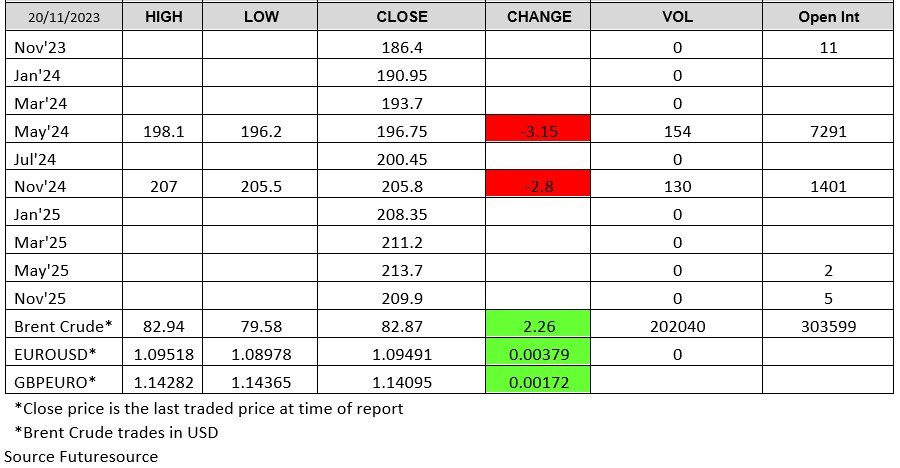

Matif rape came off in today’s trading, down around 4 euros. European wheat markets were down. Matif traded down all day around 2 euros a lot (I’m starting to sound like a broken record). London was quiet with volumes around 270 lots across the curve. No Nov 23 tenders or spread action today. All in all pretty uninspiring!

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.