London Wheat Report

Source: FutureSource

Yesterday’s brief rally was a thing of the past today as the global wheat markets returned to the same trend of late. RED. According to Reuters, yesterday’s rally came off the back of Ukraine accusing Russia of cutting the port of Pivdennyi out of a deal allowing safe Black Sea grain exports, creating uncertainty over the status of the accord that had been extended last Wednesday for two more months. This doesn’t seem to be a big enough reason to move the market as much as we saw, but you never know.

Ukrainian Deputy Renovation Minister Yuriy Vaskov accused Russia of a “gross violation” of the agreement. All ships are inspected by a joint team of Russian, Ukrainian, Turkish and U.N. inspectors, but Vaskov said the Russian inspectors had refused to inspect ships bound for Pivdennyi since April 29. “They (Russia) have now found an effective way to significantly reduce (Ukrainian) grain exports by excluding the port of Pivdennyi, which handles large tonnage vessels, from the initiative,” Vaskov said in written comments on Tuesday.

Markets didn’t really seem to have fresh direction today and continued on the bearish trend. Matif was off roughly 5 Euros across the curve. Chicago wheat was 15 cents in the red at the time of writing.

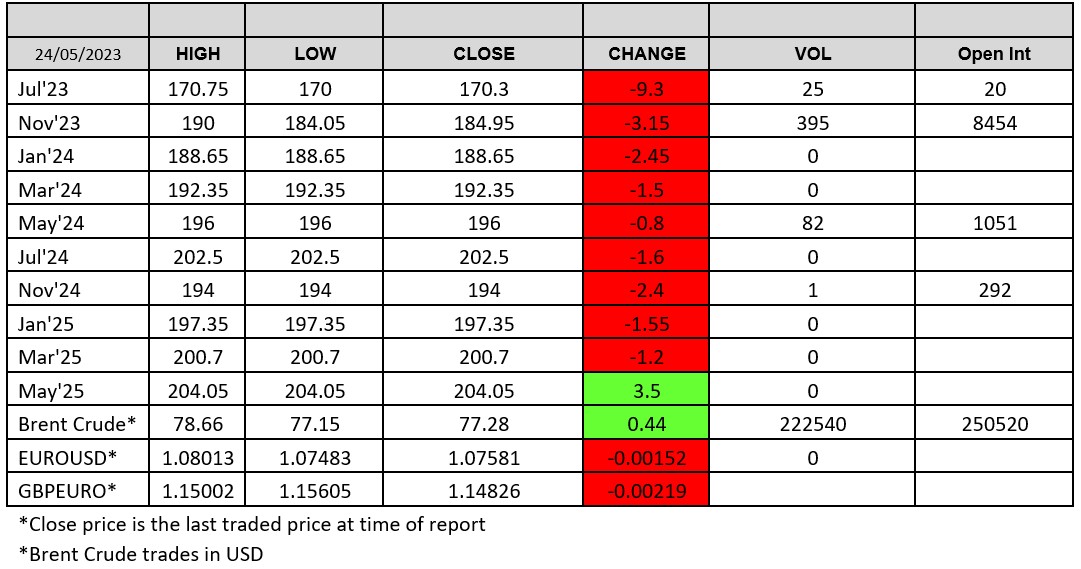

London wheat had a quiet day, Jul 23 traded for the first time in a while, all be it for 25 lots between 170 and 170.75 down nearly 10 quid on last night sett. Most volume was on Nov 23 which traded between 186 and 190. 211 lots crossing the line. Nov 24 traded for…. 1 lot @ 194.00.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.