London Wheat Report

The Isreal/ Iran Ceasefire continues to hold. The leaked damage assessment from the Pentagon’s Defense Intelligence Agency estimates the attack only set Iran’s nuclear program back “a few months”. Brent trading higher today. Chicago soybean and soyoil futures edged higher this morning, supported by a rebound in oil prices as the market monitors the fragile ceasefire between Iran and Israel. However this afternoon beans fell into double figure losses.

Brazilian farmers will produce a record 123.3 million metric tons of second corn, agribusiness consultancy Agroconsult has said after surveying fields in key producing regions nationwide. Second corn, which Brazilian farmers are harvesting now, will account for about 80% of national output this year. It is mainly exported in the second half, competing with U.S. corn suppliers on global markets. Brazil is reaping “the mother of all safrinhas,” Good weather conditions, particularly abundant rains throughout April and May, helped yields in many key growing states.

Russia is continuing to boost grain and veg oil exports to Iran thanks to an anticipated larger harvest this year and an end to trading restrictions. They are looking to capitalise from sanction imposed by the west. Trade between Russia and Iran grew by 16% to $4.8 billion last year. It primarily goes through the inland Caspian Sea, whose coastline is shared by Russia, Iran, Kazakhstan, Azerbaijan, and Turkmenistan.

Egypt’s state grains buyer, one of the world’s largest wheat importers, has purchased several hundred thousand metric tons of wheat in the past weeks for delivery in July and August. It is estimated the country have purchased between 300,000 and 400,000 already but may be looking to purchase as much 600,000. The purchases are said to be from Russia, Ukraine and Romania, with a price range of 250 USD – 258 USD a ton.

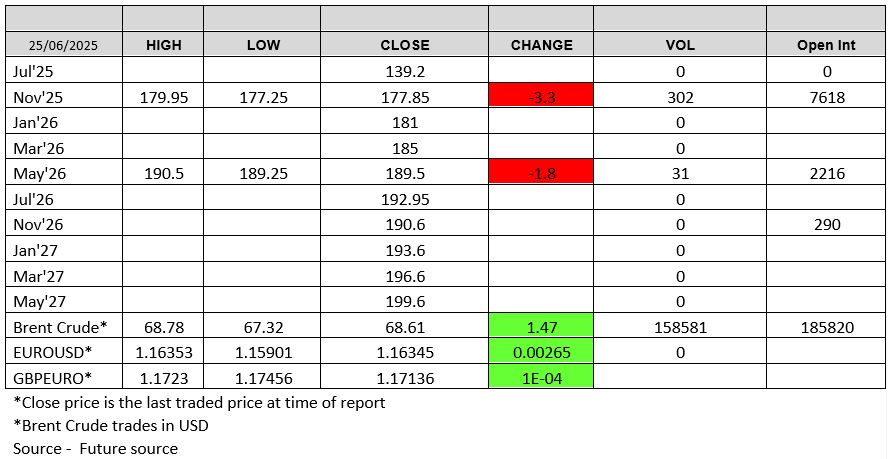

Wheat slid yesterday on de-escalation of Iran/ Isreal war, as well as a strong production outlook across the northern hemisphere and accelerating harvest activity. Warm, rainy weather in the U.S. Midwest is expected to aid crop development in the coming days. Today was no different, red across global wheat markets.

Agricultural consultancy Sovecon said on Wednesday it had slightly raised its forecast for Russian wheat production for 2025 by 0.2 million metric tons to 83.0 million metric tons, citing improved crop conditions in parts of central Russia. It also raised the total grain crop forecast to 129.5 million metric tons, up from 127.6 million metric tons in May5.

Brazil’s National Energy Policy Council (CNPE) on Wednesday approved increasing the percentage of ethanol mixed in gasoline to 30% from 27%, and the amount of biodiesel in diesel to 15% from 14%, according to G1 news website.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Ryan Easterbrook, Aaron Stockley-Isted and Jamie Kirkwood

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.