London Wheat Report

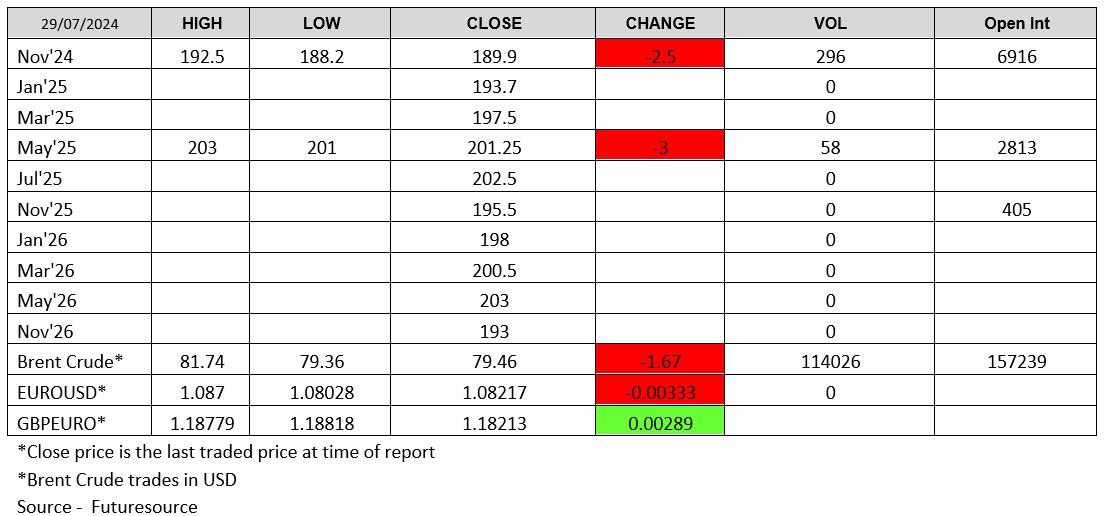

The past week has seen combines slowly starting to nibble winter wheat across the UK with the new crop beginning to feed into the market. Less that desirable harvest results so far this year in mainland Europe have reduced bearish sentiment produced by a culmination of strong harvest prospects and progress in the US and a steady flow of cheap Black Sea grain entering the market. These factors have seen global wheat markets decline 4.5% over the past 7 days.

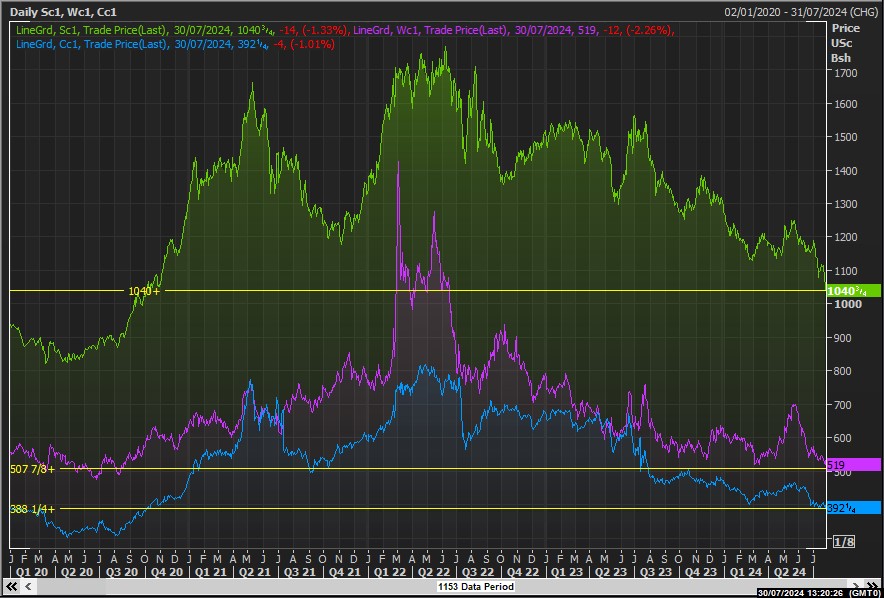

In addition to wheat, Chicago corn and soybean futures dropped today – trading near their lowest since 2020 (as seen in the below graph). U.S. crop ratings and weather charts reinforced expectations of bumper harvests whilst worries of wavering Chinese demand compounded fears of a potential glut. Corn ratings improved 1% to 68% G/E vs. expectations of dropping 1%. Some suggesting that current ratings could mean an overall US yield of roughly 183.5 bpa vs. the July USDA forecast of 181 bpa.

Source: Refinitiv

Argentina, a key global wheat exporter, has reportedly not been so lucky with its wheat crops. Freezing temperatures over the main agricultural regions at the start of this week exacerbated poor conditions in the already droughted area. This will no doubt raise questions over the condition of its 2024/25 wheat crop.

Japan is due shortly to tender for just shy of 120,000 tonnes of wheat – likely originating from United States, Canada and Australia. This will act as an interesting litmus test to see where global prices lie without the skew of Black Sea wheat.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Ryan Easterbrook, Aaron Stockley-Isted and Jamie Kirkwood

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.