London Wheat Report

Source: FutureSource

Both US and EU wheat markets edged high this afternoon after cooling off this morning as traders continue to weigh recession fears and mixed trade supply prospects. Supply concerns have been tempered with sharp rebounds in Canadian and Aussie wheat production forecasts alongside great planting conditions in the EU. Algeria announced the purchase of Russian wheat, quantity tbc, with pricing being circa $364 – $365/t c&f which was about $10 – $15/t cheaper than EU offers. Matif Dec-22 settled up €1.75 on yesterday at €332.25/t.

Poland and Ukraine will work on a cross-border pipeline project to deliver Ukrainian vegetable oils to the port of Gdańsk. As reported by the office of Prime Minister Mateusz Morawiecki, Poland has agreed to sign a corresponding memorandum with its Ukrainian counterparts. US agricultural exports for fiscal year 2023 are projected at $193.5 billion, down from a record $196 billion forecast for 2022, according to the United States Department of Agriculture (USDA).

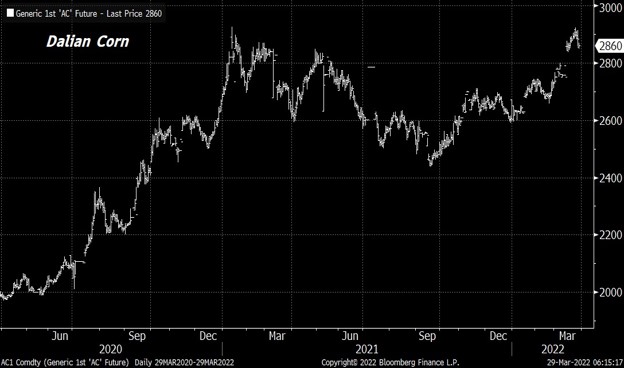

NOFI bought 137k tonnes of corn yesterday at $337.58/t c&f. European corn yields are still being smashed down, unsurprisingly, by analytical agencies. Agritel forecasts a “catastrophic” corn harvest in France this year at 10.8m tons, the lowest in more than 20 years, as drought affects crops across the continent, according to a statement. Brazil’s Paraná second corn crop harvest reached a 91% completion rate in the week ended August 29. Chicago corn remained off. Matif corn found support.

China is reported to have bought circa 167kt of soyabeans. USDA export reports are still down. All eyes towards China and their economic data, weak data and the potential for increased pork consumption goes down the pan and ergo, increased demand for US beans. Argentina’s grain producers have sold 51.6% of the 2021/22 soybean harvest so far, the country’s Ministry of Agriculture said on Tuesday, lagging behind the 62% sales rate reported at the same point in the previous season. US beans remain the cheapest currently and it is purely down to China how much they want … Matif Rapeseed Nov-22 settled up €14.25 on yesterday at €616.50/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.