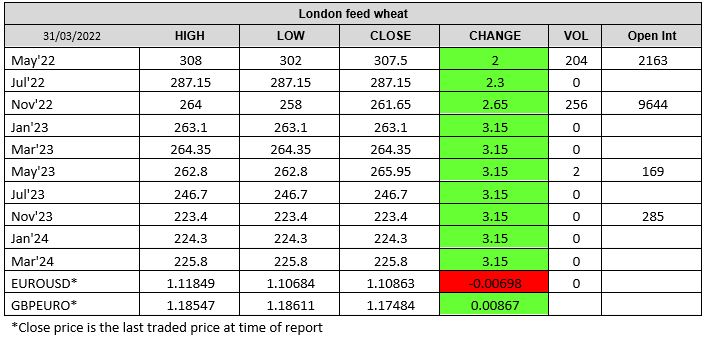

London Wheat Report

Source: FutureSource

USDA stocks and planting intentions were released today. US 2022 all wheat plantings were below trade estimates at 47.351MLN acres vs 27.771MLN acres. US 2022 corn plantings at 84.490 MLN acres vs 92.001MLN acres. Beans were bearish with USDA figures set at 90.955 MLN acres vs 92.001 MLN acres. Corn found some substantial support, Chicago May-22 trading up 8 cents at time of writing and Dec 22 hit limit up before pulling back, trading up 23 cents at time of writing. Chicago soybeans were bearish with May-22 trading down 47 cents at time of writing and Nov-22 beans trading down 47 cents at time of writing.

Chicago wheat found support with May-22, soon trading up 40 cents at time of the USDA released before settling back down, and trading down a cent at time of writing. Matif May-22 followed Chicago higher, settling up €7 on yesterday at €369.50. Algeria put in a slam dunk, buying around 600kt of wheat in a 120kt tender at a reported $448/t c&f. Origin to be confirmed although it is reported to be of French origin. Ukrainian farmers have sown about 400,000 hectares (988,000 acres) with various spring crops by Thursday, or a tenth more than by the same date last year, despite the Russian invasion, deputy agriculture minister Taras Vysotskiy said. On Thursday, Vysotskiy said Ukraine had 13 million tonnes of corn and 3.8 million tonnes of wheat in stocks by the end of March. Cofco has won a 25 year concession on a Brazil terminal in the port of Santos and will expand port capacity in Brazil to 14Mmt

Vlad signed a decree that all foreign buyers must pay in rubles for Russian Gas from April 1st and contracts will be halted if these payments are not made. We shall have to wait and see sports fans if Vlad turns the tap off. Germany have said that they do not intend to pay in rubles so there may be a gas shortage coming up. Will Gazprom turn off the tap?

The Kremlin has also announced that sunflower seed exports will be banned from Friday and a quota will be imposed of 1.5Mmt will be imposed. Turkey has reportedly bought 18kt of sunflower oil in a tender today, price tbc. Brazil’s soybean production is to reach 125.1Mmt in 2021/22, down 3.9% compared to earlier estimates. Matif rapeseed May-22 settled down €21 on yesterday at €941/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.