London Wheat Report

Source: FutureSource

Happy hump day everyone. Another day, another dollar. Vladdy has announced a 36hr cease fire in Ukraine that will be the first pause to fighting since the invasion began although the proposal has been met with a frosty reception from Ukraine. Ceasefire will start at noon on Friday and end at the end of the day on Saturday for Orthodox Christians living in the warzone. Will this be adhered to? Will the Ukrainians adhere to it? Will Wagner adhere to it? Speculation in the media that this could to an eventual end to the conflict. If only, that would be beyond amazing for so many people, especially the local populous. Regretfully, I don’t think this will be the case.

US markets were pretty off again today after starting the overnight session with some support. Minutes from last night’s FOMC meeting stipulate that the Fed is still focusing on tightening inflation. USD strengthened on the news and GBP weakened. Tunisia bought 100kt of wheat at $383/t and 75kt of Barley at $320/t. Rouen wheat export data took a tumble which didn’t help Matif wheat today. Aussie wheat crop is expected to exceed 40Mmt which will be a new record-breaking crop for the 2022/23 marketing year. Logistics, storage and port out loading facilities will limit export potential so strong carryover stocks anticipated. Nigeria faces a reported wheat crisis in its wheat supply according to local associations as imports declined 16% in the Jan-Oct 2022 period. GASC has been approved today to import grain and vegetable oils via govt-govt deals according to the Egyptian cabinet.

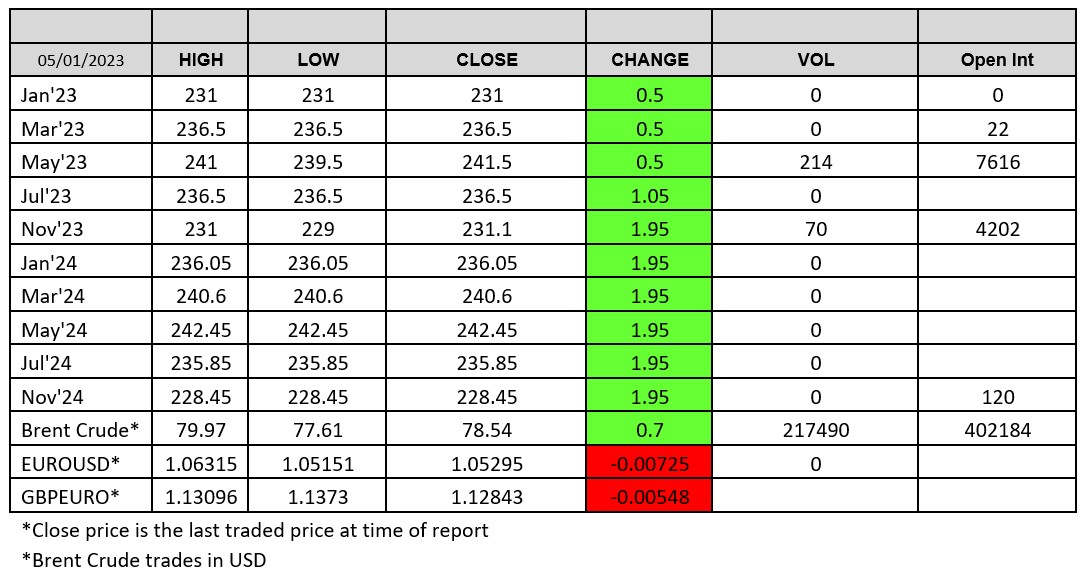

Matif wheat traded most of the day unchanged, kicking up a little into the close with Mar-23 settling up €2.75 on yesterday at €31.75/t. London had some better volumes today, especially on the May contract although prices were down.

Ukraine have completed 81% of their corn harvest with 22.1Mmt harvested. Oilseed complex was pretty mundane today both in the US and Europe. Brent crude was trading marginally higher.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.