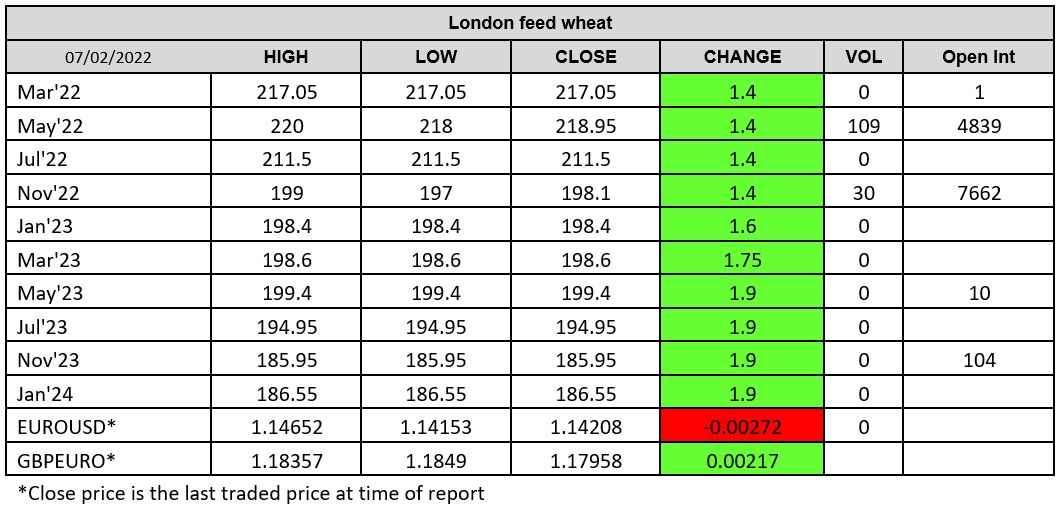

London Wheat Report

Source: FutureSource

Ag markets kicked off the week with a strong play from both the US bean complex and corn, providing leadership on production concerns. USDA announced the sale of 507kt of soybean export sales, split 249kt 21/22 and 258k 22/23 to an unknown destination. Another forecasted period of dry conditions is forecasted for the driest parts of SA, continuing to offer beans support following on from Friday. Chicago soybeans rose to their highest since June on the continued weather chatter this morning, last trading around the $15.82 mark at time of writing. Rain seen over Brazil fell over the northern and central areas. Malaysian palm oil continues to be strong, Matif May-22 rapeseed settled up €5.25 on Friday at €701.75/t.

Focus in Brazil is now shifting towards the odds of getting the second crop of corn into the southern areas. Right now, things are looking a bit sticky in the precipitation department. Lack of production last year and with supply being banked on Brazil, Argentinian corn will continue to find its way into Brazil. US supplies will also come into focus of global buyers. Chicago Mar-22 was trading at $6.35 at time of writing. Funds corn longs are approaching 400K, all time high. A lot of bullish bets are seen, potential impact if USDA’s cuts to SA crop is smaller than the bulls hope? Chinese import numbers also could be of interest. Ukrainian corn exports continue to flow out, they need the export terminals open and the Russian T90s to remain on the Russian side of the border, that’s for sure. Chinese corn buying and tit for tat trade spat with the US will be on Ukraine’s side as they will not want any meddling with one of their immediate corn supply partners.

Wheat remains underpinned by Black Sea political tension and markets are also positioning themselves ahead of the USDA’s forecasts on Wednesday. Ukraine winter crops are reported to be in good or satisfactory state currently according to APK-Inform (tank tracks pending). Russian exports are reported down by 27.5% on last year so far according to AgMin. South Korea bought some 110kt of feed wheat according to traders, origin tbc. Syria issued a tender today to buy 200kt of milling wheat according to traders. Egypt aims to procure 4mmt of wheat in their domestic harvest according to their Ag Ministry, up from 3.6Mmt last year. Matif Mar-22 settled up after hitting a four month low with London following suit.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston, Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.