London Wheat Report

Charles III delivered his first King’s Speech to Parliament, marking the start of the parliamentary year. Spurs were brought back down to earth with a bump with a heavy defeat at home to Chelsea.. no one likes to see that!!!

Saudi Aramco had disappointing Q3 results, *just* the $32.6 Billion net profit this time out. Down 23% from the previous year. The smaller profits were down to lower oil prices and volumes sold. The Saudi oil producer said lower oil prices and volumes were partially offset by a reduction in production royalties. Aramco’s revenue fell to $113.09 billion in the quarter from $144.99 billion a year earlier. It paid out $14.7 billion in royalties and other taxes, down from $24.3 billion a year earlier, the company said.

NY Cocoa is telling a story of late, currently trading at its highest levels for nearly 45 years. The driving force in this market is tightened supplies due to lower production from Ivory Coast and Ghana. Market trading @ the high of $3969 a lot today.

USDA weekly crop rating showed the US winter Wheat crop at 50% Good to excellent. Up three % points up from last week, and the highest for this time of year since 2019. This has been put down to soil moisture improvements after three years of drought. Improved production from the 4th biggest wheat exporter will undoubtedly help curb some concerns about global grain supplies.

U.S. farmers continue to harvest corn and soybeans. The corn harvest was 81% complete by Sunday, slightly below the average analyst estimate of 82% but ahead of the five-year average pace of 77%. Similarly, the soybean harvest was 91% done, behind the average estimate of 92% but ahead of the five-year average of 86%.

China imported 5.16 million metric tons of soybeans in October, customs data showed on Tuesday, a 25% surge from a year earlier but lower than analysts’ expectations as Brazilian soybeans continued to arrive at ports later than usual.

Weather – Never mind Love is all around, it’s looking more like rain is all around… Wet Wet Wet. Domestic weather forecasts show rain for the foreseeable, this is similar to most of western Europe as well as the Balkans, Ukraine and much of Russia’s winter wheat belt. Central US forecast remains dry for the next 10 days, the opposite in the far S. plains. Southern America is being pounded with heavy rain in Brazil and most of Argentina.

Despite the adverse weather, Brazil’s soybean plantings are 51% complete, up 11% on the week and only 6% behind last year’s pace- it’s the slowest planting pace since 2020/21. Brazil’s AgRural estimates winter corn is 66% complete vs 63% a year ago. The real kicker for grains will be if the pace doesn’t pick up and the second corn crop is delayed as a result. Another big debate is, how much of that 51% planted soybeans will need to be ripped up and replaced/replanted due to germination failure in wet conditions.

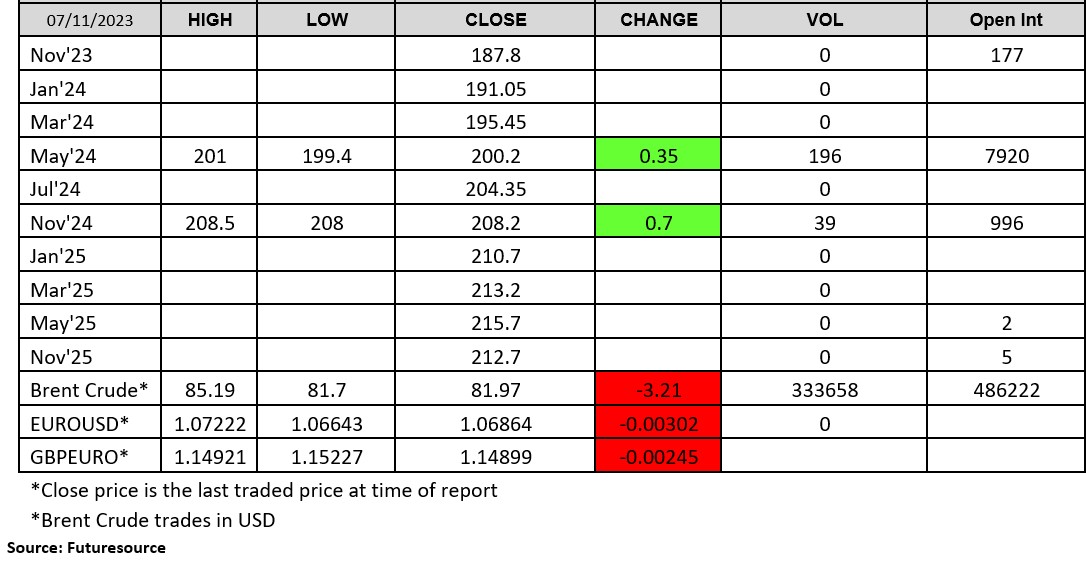

London wheat futures volumes were average today. It took until after lunch to see any kind of volume going through. By the end of the trading session, 220 odd lots crossed the finish line. The market found some support closing slightly higher.

A reminder that Global Grains is taking place in Geneva, Ryan will be there Wednesday/Thursday. USDA Report is due on Thursday 9th November.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.