London Wheat Report

Source: FutureSource

Ag markets in correction mode ahead of tomorrow’s WASDE report. Speculative investors are taking off some of the long risk ahead of tomorrow’s report. Vast majority of spec interest in the row crops coming from the long side, positioning for them ahead of tomorrow’s report is likely to the downside. Wheat does not have the overwhelming spec long position that corn or beans do, so we expect to see less potential for downside.

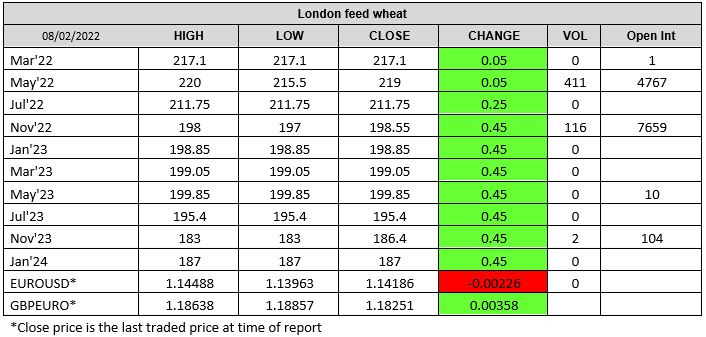

Wheat markets were mixed today. StatsCan released their report for the Canadian grain stocks as of 31st December. All wheat stocks were placed at 15.56Mmt, this is 9.5Mmt lower than last December. Trade was anticipating 17.5Mmt. This offered support to Minneapolis which was trading up circa 14 cents on front month at time of writing. It also reiterates to the market that Canadian traders are continuing to shift supplies when they can and may be down to nothing more than bin sweepings come summer time. Matif wheat remained unchanged to bearish for the majority of the day’s trade. Market chatter about French quality being an issue into W Africa and little demand seen from Morocco and Algeria. France will also start to be looking out longer term for what the Russian/Chinese wheat deal will mean longer term as China was seen as one of the last ‘captive’ markets for French wheat. Black Sea trade was quiet ahead of the WASDE report. London wheat settled marginally up.

Soybeans were softer overnight. USDA reported new crop beans sales this morning equating 132kt to China and 332kt to unknown. Brent crude was trading down 2.5% at $90.38/ba at time of writing. Matif rapeseed also cooled off, with May-22 settling down €24.75 on yesterday at €677/t. Corn chatter remained pretty standard, all weather related. Chicago corn was trading down. Turkey bought preliminary covered 325kt of corn mostly from local suppliers, paying around $304.70/t c&f.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.