London Wheat Report

A lengthy report to get your teeth in to this evening with a lot going on.

Global Ags markets were on the charge today. A perfect storm of weather stories, USDA report anxiety, along with unfavourable geopolitics drove the markets Up Up and Away. Chicago and Kansas wheat rose nearly 30 cents, Corn up 12 cents, Beans up 20 odd cents. Matif EBM up over 5 euros and London following up, nearly £5.00.

Argentina’s wheat crop has been downgraded nearly a million tonnes as rains have come too late. 13.5 M tonnes is now the new figure. Although rain has finally arrived, it follows Argentina’s worst drought in the country’s history.

Large Chinese buying was a factor in the beans markets flying. The U.S. Department of Agriculture confirmed private sales of 909,500 metric tons of U.S. soybeans on Wednesday, the largest single-day soy sales total since at least late July.

Russian agricultural ministry has estimated the countries grain exports to be 65M tonnes this year. The ministry are also claiming that Russia has harvested 147M metric tonnes of grain in 2023 to date. The Grain deal – remember that? Well today, Segei Lavrov has said that UN attempts to revive the BSGD were ‘’bearing no results’’. UN agreed. Ukraine ship exports have been steady none the less, and an increased number of stevedoring at Ukrainian ports in recent months seems to suggest they see no problems using their shore hugging export route.

Heavy rainfall in France over the past two weeks has brought grain sowing virtually to a standstill in the European Union’s largest grain grower and lower yields are to be expected in some regions. ‘’Farmers benefited from very favorable sowing conditions at the start of the planting season, but above-average rainfall in the last ten days of October hampered sowings’’ a crop engineer told Reuters.

The ongoing El Nino weather pattern is set to last until at least April 2024, the World Meteorological Organization (WMO) said on Wednesday, pushing up temperatures in a year already on track to be the warmest on record. Australia followed the driest Sept on record with the 5th driest Oct on record. Australia’s Bureau of Meteorology estimated Aussie wheat production at 25.4 MMT.

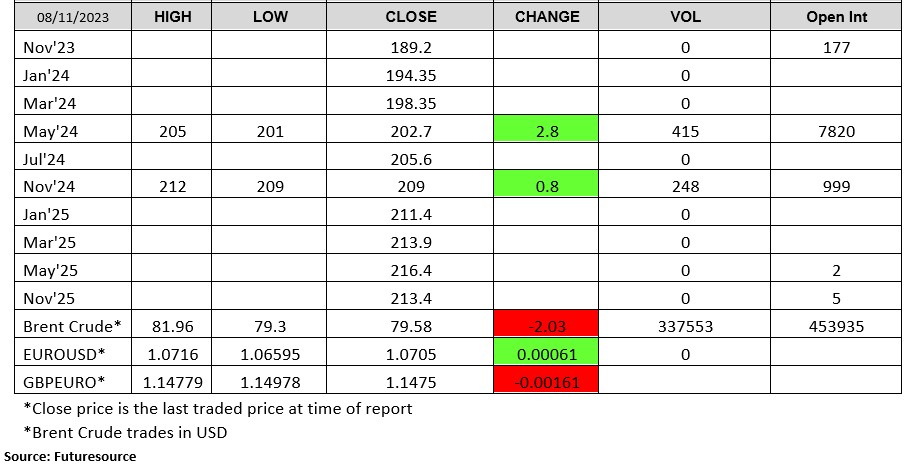

Off the back of matif roaring up 5 euros. London Wheat futures had a slightly more productive day than yesterday. May 24 traded up all day between £201 and 205 (that’s up £4.80). Nov 24 trading today for 80 lots @ 209 before finding further support and trading up to £212 majority of the volume looked to be going through at £211.50/212.. OI on the Nov 23 position didn’t move with 177 lots holding on for dear life, untraded today. In total nearly 700 lots crossed the finish line across the curve.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.